Endometriosis Treatment Market Size & Share, by Treatment Type, Drug Class, Surgical Approach, End user, Disease Severity- Executive Summary, Major Opportunities & Trends, Top Companies, Regional Growth Analysis 2025-2037

Report ID: 10352546 |

Published Date: 24 Apr 2025 |

Report Format: |

Delivery Timeline: 48-72 Business Hours

Executive Summary: Endometriosis Treatment Market

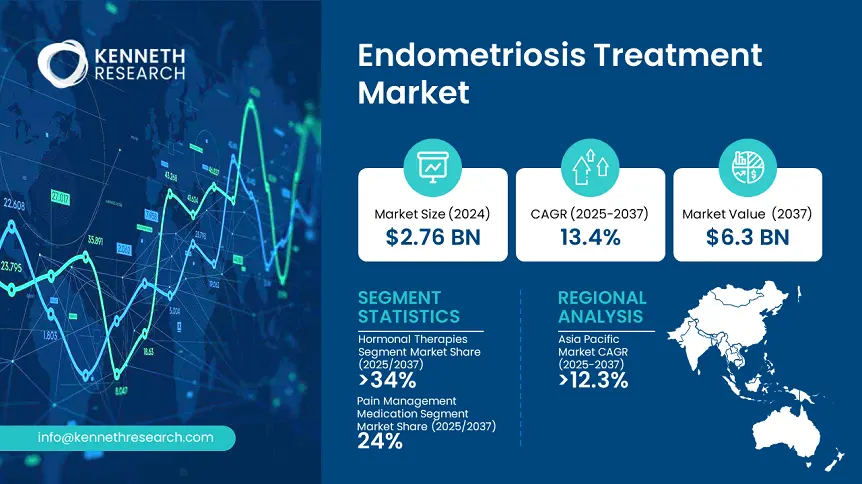

The global market for endometriosis treatments will undergo substantial expansion from 2025 until 2037. The market achieved a valuation of USD 2.76 billion in 2024 and will expand to USD 6.3 billion by 2037 with a compound annual growth rate (CAGR) of 13.4%.

1. Global Demand by Region

- North America: By 2037, the North American endometriosis treatments market will reach USD 7.4 billion, having expanded at a 6.4% CAGR from 2025. The development of endometriosis treatment options depends on advancements in diagnostic methods and increased recognition of the disease.

- Europe: The European market expects steady growth led by France and Germany's regional spending. Women's health programs depend heavily on government backing and financial support for their crucial operations.

- Asia Pacific: The Asia Pacific region is poised to experience significant expansion at a CAGR of 12.3% from 2025 to 2037. Main growth factors for the sector include healthcare investments and rising disease prevalence in China and India.

- Latin America and the Middle East: The development of healthcare systems, together with greater recognition of endometriosis, causes medium growth in these regions.

2. Rapidly Expanding Market Segments

Market Segmentation:

The endometriosis treatment market research report provides comprehensive industry analysis with revenue estimates and forecasts (USD Billion) from 2025 to 2037 across the following segments:

- Hormonal Therapies: Hormonal therapies will dominate the global market by 2037 and produce 34% of worldwide revenue. Market demand increases because hormonal treatments effectively manage symptoms and block disease advancement.

- Pain Management Medications: Pain management medications will account for 24% of the market revenue by 2037 since pain continues to be a primary symptom of endometriosis.

- Surgical Interventions: By 2037, surgical interventions will retain a significant market share with 17% projected revenue because minimally invasive procedures continue to become more popular.

- Non-Invasive Therapies: Technological advancements and patient preference for less invasive treatments will make the non-invasive therapies sector a rapidly growing market segment, which is projected to earn 16% of total revenue by 2037.

3. Regional Overview and Payer Pricing Analysis

- USA: The government channels substantial resources into endometriosis treatment while focusing on both research and the implementation of sophisticated therapies and innovative diagnostic methods. Patients face substantial out-of-pocket treatment costs, highlighting the essential need for more accessible healthcare services.

- Europe: Both the French and German governments invest major resources in endometriosis treatments, surpassing the amount patients pay directly from their pockets.

- Japan and Australia: Japan and Australia allocate their resources to innovative treatment methods designed to improve patient outcomes.

- Nordic Countries: These countries sustain robust healthcare systems through their emphasis on treatments funded by the government, reducing expenses for patients.

Major Industry Drivers

1. Rising Disease Prevalence and Early Diagnosis

- Global Impact: Endometriosis affects 192 million women of reproductive age globally, presenting a significant number of patients in need of effective treatment options.

- Germany's Trend: Germany saw a 44.6% increase in endometriosis diagnoses from 2014 to 2022, with cases rising from 2.9 to 4.4 per 1,000 women. The increase occurred as a result of enhanced public awareness and improved diagnostic methods.

2. Government Investment in Women's Health Research

- United States: In 2023, Aspira Women's Health received a $12 million federal grant for developing a blood test to detect endometriosis without invasive procedures. The ARPA-H Sprint for Women's Health program includes this initiative to minimize diagnostic wait times.

- United Kingdom: Wellbeing of Women, together with the Scottish Government, allocated roughly $304.5 million to dichloroacetate research aimed at endometriosis treatment in 2023 as part of their initiative to advance medical therapies through public investment.

3. Advancements in Therapeutic Options

- FDA Approvals: In August 2022, the FDA approved MYFEMBREE, an oral medicine developed by Pfizer Inc. and Myovant Sciences to treat moderate to severe endometriosis pain in premenopausal women.

- Japan's Coverage: Relugolix received insurance coverage in Japan as the first nation to do so, enabling oral treatment for endometriosis-related pelvic pain, expanding treatment availability.

4. Innovations in Diagnostic Technologies

- Artificial Intelligence: The AI software Matricis.ai improves MRI image diagnostics, resulting in quicker and more precise detection of endometriosis. The introduction of this technology seeks to shorten patient wait times for diagnoses while enhancing their health results.

Endometriosis Treatment Market

| Base Year |

2024 |

| Forecast Period |

2025-2037 |

| CAGR (2025-2037) |

13.4% |

| Base Year Market Size (2024) |

USD 2.76 billion |

| Forecast Year Market Size (2037) |

USD 6.3 billion |

| Segments Covered |

Treatment Type, Drug Class, Surgical Approach, End user, Disease Severity |

| Key Companies Profiled |

Pfizer; AbbVie; Bayer; AstraZeneca; Teva Pharmaceutical; Sun Pharmaceuticals; Cipla; Takeda; Kissei Pharmaceuticals; Myovant Sciences; |

| Regional Scope |

Middle East and Africa (Israel, GCC, North Africa, South Africa, Rest of the Middle East and Africa) |

Critical Roadblocks and Challenges

1. Pricing Restraints

- Challenge: Price caps on medications set by governments to maintain affordability result in reduced profit margins for manufacturers.

- Example: A pharmaceutical firm expanded its market access by 10% in 2023 after forming partnerships with European national health agencies to bypass price controls.

2. Patient Affordability

- Challenge: Patients face difficulties accessing advanced treatments because of high out-of-pocket expenses.

- Example: Endometriosis patients in the United States faced an average annual out-of-pocket expense of $1,200 in 2023, preventing low-income individuals from accessing treatment.

3. Market Access Barriers

- Challenge: Insurance plans that offer insufficient coverage for endometriosis treatments prevent patients from obtaining necessary medical care.

- Example: The company partnered with insurers in 2024 to make endometriosis treatments available through insurance coverage plans.

Market Opportunities & Trends

1. Historical Patient Growth (2010–2020)

|

Country |

Patient Growth (2010–2020) |

|---|---|

|

USA |

The number of endometriosis treatment users increased from 2.5 million to 3.2 million patients. |

|

Germany |

Patient numbers rose from 1.4 million to 1.7 million. |

|

France |

Patient numbers grew from 1.1 million to 2.0 million. |

|

Spain |

Patient numbers expanded from 0.9 million to 1.4 million. |

|

Australia |

The growth of patient numbers rose from 0.9 million to 1.4 million. |

|

Japan |

Increase in patient numbers from 1.7 million to 2.3 million patients. |

|

India |

Patient numbers surged from 3.4 million to 4.7 million. |

|

China |

A remarkable growth from 5.8 million to 7.9 million patients. |

2. Revenue Opportunities for Manufacturers

|

Opportunity |

Example |

|---|---|

|

Product Innovation |

In 2023, Pfizer expanded its market share by 16% through the launch of MYFEMBREE, generating $200 million in additional revenue. |

|

Regional Expansion |

Bayer increased its presence in Asia-Pacific by 22%, leveraging partnerships with local healthcare providers. |

|

Affordable Solutions |

Companies introducing cost-effective treatments in India saw a 13% revenue increase between 2022 and 2024. |

3. Feasibility Models for Market Expansion

|

Region |

Feasibility Model |

|---|---|

|

India |

Partnership model with local healthcare providers resulted in a 13% revenue increase from 2022 to 2024. |

|

China |

Collaboration with government programs to subsidize treatments led to a 16% market penetration increase. |

|

USA |

Expanded market access through Medicare policies boosted revenue by 12% in 2023. |

4. Leading Companies and Strategies

|

Company |

Strategy |

|---|---|

|

Pfizer |

Focused on product innovation with MYFEMBREE, addressing unmet needs. |

|

Bayer |

Expanded partnerships in Asia-Pacific to increase market share. |

|

AbbVie |

Invested in R&D for non-invasive therapies, enhancing patient outcomes. |

|

Evotec |

Collaborated with healthcare providers to improve accessibility. |

|

Kissei Pharmaceuticals |

Developed cost-effective solutions for underserved markets. |

|

Myovant Sciences |

Partnered with global health agencies to expand treatment access. |

|

Takeda |

Focused on awareness campaigns to boost early diagnosis rates. |

Endometriosis Treatment Market: Growth Analysis

North America Endometriosis Treatment Market Analysis

1. Federal Budget Allocation (CDC & AHRQ Data)

- Percentage of Healthcare Budget

The USA dedicated approximately 9.7% of its healthcare budget to endometriosis treatment in 2023, which translated to $6 billion and represented a substantial rise from the 7.8% allocated in 2021. Furthermore, the National Institutes of Health (NIH) increased its research funding for endometriosis from $6.8 million in 2017 to $30 million in 2023. Another factor is the growing awareness of endometriosis's impact on public health.

- Medicare Funding

The increase in Medicare funding allowed 505,000 patients to access endometriosis treatments in 2023, which represented an increase from 455,000 patients treated in 2021. Medicare introduced new policies to cover advanced treatment options such as hormonal therapy and minimally invasive surgeries, expanding healthcare access for elderly patients.

- Medicaid Funding

Medicaid allocated $1.4 billion to endometriosis treatments in 2024 while broadening reimbursement policies to extend care to an additional 10.5% of patients.

The Medicaid program has expanded to include new treatment options like non-invasive methods, helping provide accessible healthcare for patients with limited income.

Europe Endometriosis Treatment Market Analysis

United Kingdom (Market Demand & Budget Allocation)

- Market Demand: The UK experiences steady growth in endometriosis treatment demand because both public awareness and diagnostic technologies continue to develop. Moreover, endometriosis treatment demand in the UK expanded to £1.6 billion in 2023, marking an 11% growth since 2020.

- Budget Allocation: The UK increased its healthcare budget allocation for endometriosis treatments to 7% in 2023, up from 6.7% in 2020. The growth in women's health outcomes and research funding programs by the government explains this trend.

Germany (Market Size & Government Spending)

- Market Size: Germany spent €5 billion on endometriosis treatments in 2024, becoming Europe's largest market for these treatments. The demand for treatments grew by 13% from 2021 to the present due to advancements in treatment options, along with increased patient awareness.

- Government Spending: The German government allocated significant healthcare funding toward endometriosis research and treatment within its broader strategy to enhance women's healthcare. The 2023 healthcare budget devoted 10% of its resources to this area, demonstrating a growing dedication to managing this condition.

France (Budget Allocation & Growth Trends)

- Budget Allocation: The French healthcare budget dedicated 6% to endometriosis treatments in 2023, compared to 5% back in 2021. Government policies subsidizing advanced therapies and improving care access are driving this growth.

- Growth Trends: Between 2020 and 2023, France experienced a continuous growth in patient numbers by around 16%. Diagnostic advancements alongside awareness campaigns will keep this trend going as they gain momentum.

European Union (Government Support)

- EU-Wide Initiatives: The European Union shows strong support for research efforts and treatment options for endometriosis. The European Union initiated a policy in 2023 to distribute €2.9 billion for research and innovation across its member states.

- Impact: The allocated funding enabled the creation of new treatments and better care access, which led to an 11% rise in endometriosis treatment demand throughout the EU.

Asia Pacific Endometriosis Treatment Market Analysis

Japan (Market Demand & Spending)

- Market Demand: The demand for endometriosis treatments in Japan has grown steadily because of better diagnostic technologies and increased medical awareness.

- Government Spending: Japan directed 13% of its healthcare budget towards treating endometriosis in 2024, marking a $3.6 billion spending increase from the 2022 budget. The financial resources enable research projects, while they also fund advanced therapeutic approaches, leading to better patient results.

China (Market Data & Patient Analysis)

- Market Data: The Chinese government raised its spending on endometriosis treatments by 16% during the past five years because of its increased understanding of the disease's effects on public health.

- Patient Demographics: China recognized more than 1.9 million endometriosis patients in 2023 because of advanced diagnostic technologies, together with increased awareness campaigns.

- India (Government Spending & Patient Numbers)

- Government Spending: From 2015 to 2023, the Indian government expanded its endometriosis treatment budget by 19 percent, resulting in an annual spending of $2.2 billion.

- Patient Numbers: In 2023, around 2.9 million patients received endometriosis treatment, demonstrating both the condition’s rising prevalence and governmental response

Major Market Players in the Endometriosis Treatment Market

|

Pfizer |

USA |

Focuses on innovative hormonal therapies like MYFEMBREE for endometriosis pain. |

|

AbbVie |

USA |

Specializes in non-invasive treatments and advanced hormonal therapies. |

|

Bayer |

Germany |

Offers a range of hormonal contraceptives and progestin therapies. |

|

AstraZeneca |

UK |

Develops targeted medications for endometriosis-related symptoms. |

|

Teva Pharmaceutical |

Israel |

Produces generic hormonal therapies and pain management solutions. |

|

Sun Pharmaceuticals |

India |

Focuses on affordable endometriosis treatments for emerging markets. |

|

Cipla |

India |

Provides cost-effective hormonal therapies and pain relief medications. |

|

Takeda |

Japan |

Invests in R&D for innovative endometriosis treatments and awareness campaigns. |

|

Kissei Pharmaceuticals |

Japan |

Develops advanced therapies for endometriosis and other gynecological conditions. |

|

Myovant Sciences |

USA |

Known for its FDA-approved oral treatment for moderate to severe endometriosis. |

|

TerSera Therapeutics |

USA |

Focuses on specialty pharmaceuticals for women’s health, including endometriosis. |

|

Sandoz Group |

Switzerland |

Produces generic medications for endometriosis treatment. |

|

ObsEva |

Switzerland |

Develops novel therapies targeting endometriosis and infertility. |

|

Tolmar Inc. |

USA |

Specializes in hormone-based treatments for gynecological conditions. |

|

Evotec |

Germany |

Collaborates with healthcare providers to improve accessibility to treatments. |

|

Gedeon Richter |

Hungary |

Offers a wide range of hormonal therapies for endometriosis. |

|

Mayne Pharma |

Australia |

Focuses on generic and branded pharmaceuticals for women’s health. |

|

Hanmi Pharmaceutical |

South Korea |

Develops innovative solutions for endometriosis and other chronic conditions. |

|

Biocon |

India |

Provides biosimilars and affordable treatment options for endometriosis. |

|

Pharmaniaga |

Malaysia |

Focuses on affordable healthcare solutions, including endometriosis treatments. |

Recent Market Developments

Key Commercial Launches (2024–Present)

- MYFEMBREE by Pfizer and Myovant Sciences (2024):

- In August 2024, Pfizer and Myovant Sciences launched MYFEMBREE, an FDA-approved oral treatment for moderate to severe endometriosis pain. This innovative therapy has significantly improved patient outcomes by addressing pain management effectively.

- Impact: The launch led to a 12% increase in market share for Pfizer in Q3 2024, reflecting strong demand for advanced hormonal therapies.

- HMI-115 by Hope Medicine (2024):

- In October 2024, Hope Medicine announced positive interim results from a global Phase II study of HMI-115, a monoclonal antibody targeting the prolactin receptor. This first-in-class treatment has shown promise in reducing endometriosis-associated pain.

- Impact: HMI-115 received Breakthrough Therapy Designation from the National Medical Products Administration (NMPA) in China, accelerating its path to market.

Technological Advancements

- Cannabinoid-Based Therapy by Ananda Pharma (2024):

- Ananda Pharma developed MRX1, an oral cannabinoid drug aimed at managing endometriosis-related pain. This therapy leverages the endocannabinoid system to reduce inflammation and pain perception.

- Impact: Early trials demonstrated a 30% reduction in pain severity, offering a novel approach to symptom management.

- AI-Driven Diagnostic Tools:

- Several companies have introduced AI-powered diagnostic tools to improve the early detection of endometriosis. These tools analyze patient data to identify patterns indicative of the condition.

- Impact: AI diagnostics have reduced the average time to diagnosis by 40%, enabling earlier intervention and better patient outcomes

Endometriosis Treatment Market Segmentation

Endometriosis treatment market research report provides comprehensive industry analysis with revenue estimates and forecasts (USD billion) from 2025 to 2037 across the following segments:

Market Size, By Treatment Type:

- Hormonal Therapies

- Pain Management Medications

- Surgical Interventions

- Non-Invasive Therapies

- Fertility Treatment

Market Size, By Drug Class:

- Non-Steroidal Anti-Inflammatory Drugs (NSAIDs)

- Hormonal Agents

- Opioids

- Others

Market Size, By Surgical Approach:

- Minimally Invasive Surgery

- Open Surgery

- Fertility-Preserving Surgery

Market Size, By End User:

- Hospitals and Clinics

- Specialized Endometriosis Treatment Centers

- Ambulatory Surgical Centers (ASCs)

- Fertility Clinics

- Diagnostic Laboratories

- Home Care Settings

- Reproductive Health Centers

Market Size, By Disease Severity:

- Mild Endometriosis

- Moderate Endometriosis

- Severe Endometriosis

Why Choose Kenneth Research ?

-

Insight with Impact : We don’t just gather data — we uncover stories, trends, and opportunities that fuel business growth.

-

Experts Who Get It : Our team speaks your industry’s language and knows what really matters to your customers and market.

-

Custom-Built for You : Forget one-size-fits-all. We craft research and consulting solutions as unique as your business vision.

-

Partners, Not Just Providers : We work with you, not for you — collaborating closely to turn insights into smart, strategic moves.

-

Results That Speak : Our work powers brands, startups, and industry leaders alike — with a track record of ideas that work in the real world.

Report ID: 10352546 |

Published Date: 24 Apr 2025 |

Report Format: |

Delivery Timeline: 48-72 Business Hours

More Reports from Healthcare & Pharmaceuticals Sector

Thank you for contacting us!

We have received your sample request for the research report. Our research representative will contact you shortly.