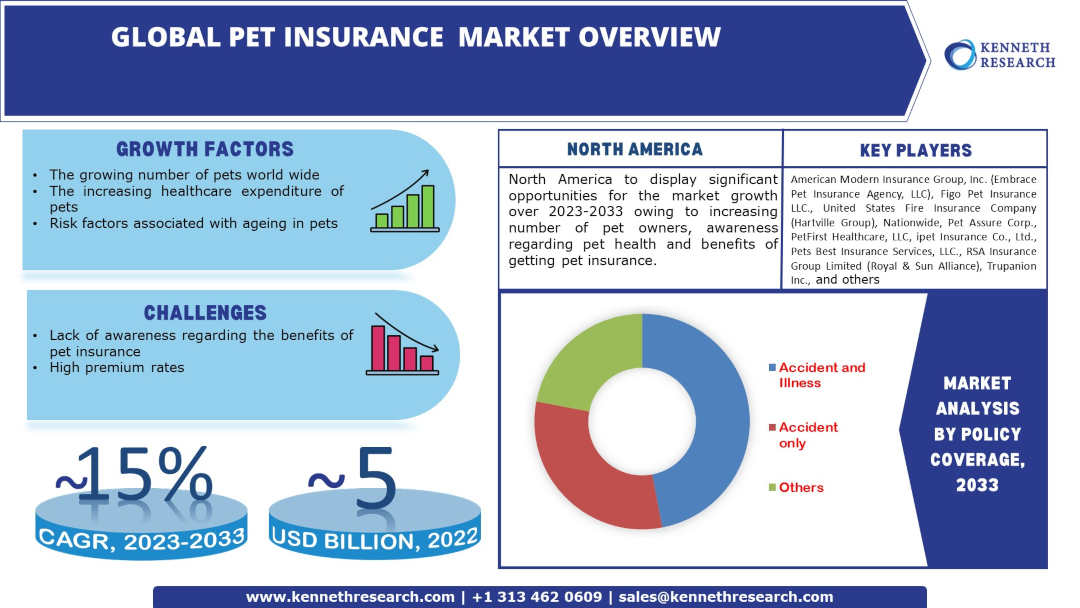

Global Pet Insurance Market Analysis by Policy Coverage (Accident Only, Accident and Illness, and Others); by Animal Type (Dogs, Cats, and Others); by Sales Channel (Agency, Broker, and Others)-Global Supply & Demand Analysis & Opportunity Outlook 2023-2033

-

Product Code:

RP-ID-10075585 -

Published Date:

21 Oct 2022 -

Region:

Global

-

Category:

Service Industry -

Publisher:

Pub-ID-54

Impact Analysis on the Growth of Market

Inflation and Looming Recession to Haunt Businesses:

In 2022 & 2023, market players expected to sail in rough waters; might incur losses due to huge gap in currency translation followed by contracting revenues, shrinking profit margins & cost pressure on logistics and supply chain. Further, U.S. economy is expected to grow merely by 3% in 2022.

....

The Research Report is Updated with 2022 Base Year, 2023 Estimated year and Forecast till 2035 with Market Insights.

With the dip in global production, the GDP has contracted in 2020 and impacted the market across the world. Upon placing a Sample Request, you will receive an updated report with 2022 as base year, 2023 as estimated year and forecast to 2035. This will have market drivers, recovery rate in the market, insights and competitive analysis.

Market Overview:

Translate Report

Global Pet Insurance Market Scope Report

|

Base Year |

2022 |

|

Forecast Year |

2023-2033 |

|

CAGR |

~15% |

|

Base Year Market Size (2022) |

~ USD 5 Billion |

|

Forecast Year Market Size (2033) |

~ USD 17 Billion |

Global Pet Insurance Market Size, Forecast, and Trend Highlights Over 2023 - 2033

The global pet insurance market is estimated to garner a revenue of USD 17 billion by the end of 2033 by growing at a CAGR of ~15% over the forecast period, i.e., 2023 – 2033. Further, the market generated a revenue of USD 5 billion in the year 2022. A study indicates that as per statistics 1oo,000 dogs are killed by riding in pickup truck beds every year. Even if they don’t get killed they are seriously injured. Most of the car accidents that happen while traveling with dogs are because they are not properly restrained. In addition, only 13.8% of pet owners use a crate or a carrier, 33.3% use a seat belt/harness, and 7.9% have a pet barrier. As such, more than 10,000 dogs are, either injured or killed in accidents each year.

GET A SAMPLE COPY OF THIS REPORT

Many studies have confirmed the positive role pets play in our lives. As demonstrated by evidence, pet owners have reduced serum cholesterol, low triglyceride levels, and fewer cardiovascular issues since owning a pet can increase the activity of pet owners. Some studies also suggest that pet owners have higher self-esteem and are generally less likely to suffer from depression and mental stress. The average cost of owning a dog as per a report can be anywhere between USD 125 to USD 824 per month and USD 1,500 to USD 9,900 per year. Routine Veterinary Care for a healthy dog can also go up from a minimum of USD 700 to a maximum of USD 2,000

Since pets gradually become a part of the family and are treated with love and care, getting them insured is not only practical but also a responsible approach. Pet Insurance refers to the insurance policy cover purchased by pet owners to nominalize their pet’s medical bills and to meet the expensive veterinary clinic costs. Pet insurance normally covers emergencies, illnesses, and injuries due to accidents, although in some cases it also provides cover for damage or injuries to third parties. Pet insurance provides a range of alternative treatments for dental issues, parasite-borne diseases, cataracts, fractures, pregnancy complications, and age-related issues of pets, and other benefits of coverage as per the policy chosen.

Global Pet Insurance Market: Growth Drivers and Challenges

Growth Drivers

-

Rising Awareness Regarding Pet care: As per statistics 43% of dog owners and 41% of cat owners buy premium pet food. According to a report, retail sales of cat and dog food nearly hit USD 40 billion in 2021, a 15% increase from 2020 in the United States.

-

Advancements in Pet Healthcare: Gene therapy treatments for cancer in dogs, vaccines, and monoclonal antibodies which reduce the need for antibiotics, high-tech collars, and gadgets monitoring their wellbeing have taken place of conventional care in pets. In addition, according to a study, 40% of millennial pet owners believe telemedicine is a very important option for pet health care.

-

Insurance Cover for Lost or Stolen Pets – As per estimates given by The American Humane Association, over 10 million dogs and cats are lost or stolen in the U.S. every year. In other words, one out of three pets will be lost at some point during their life. As one-third of all dogs and cats go missing in their lifetimes more than 80% are never found.

-

Government Policies Safeguarding Animal Rights: In the UK there are over 20 pieces of legislation that apply to dog ownership. Breaking any one of them can lead to an enormous fine and even a prison sentence.

-

Rising number of pet adoption: Each year, more than 6.5 million animal companions end up in shelters. Of all the yearly adopted dogs, only 6% are picked up from the streets, 34% are taken from breeders, while another 20% comes from friends and family. Rest 23% come from shelters, as such they have a higher chance of adoption if they are previously insured.

Challenges

-

Lack of Awareness Among Pet Owners Regarding the benefits of Pet Insurance

-

High Premium costs of policies

-

Lengthy Formalities

The global pet insurance market is segmented and analyzed for demand and supply by into policy coverage into accident only, accident and illness, and others. Amongst them, accident and illness, sub segment is anticipated to hold the largest market share. As per statistics, more than 1 million new cases of cancer reportedly occur in dogs each year in the United States. Cancer is the most common cause of death with an estimated rate of ~30%. Few of them are spontaneously occurring tumors, some histotypes include non-Hodgkin lymphoma, malignant melanoma, osteosarcoma (OSA), bladder carcinoma, and multiple brain cancer types among others leading to increasing canine mortality. To find the best options for treatment and meet the required expenditure, pet owners prefer insurance cover.

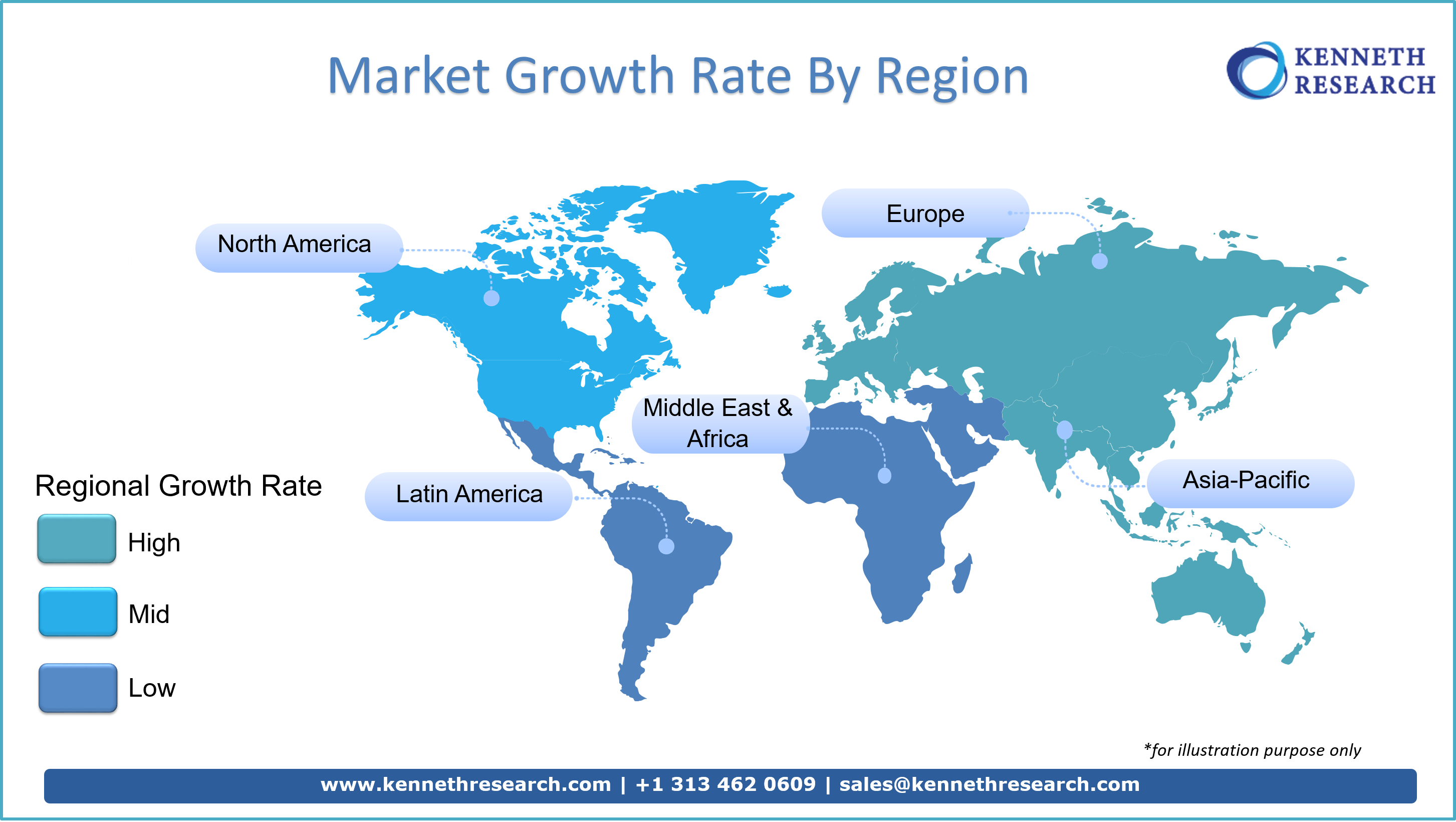

Global Pet Insurance Market Regional Synopsis

Regionally, the global pet in market is studied into five major regions including North America, Europe, Asia Pacific, Latin America and Middle East & Africa region. Amongst these markets, the market in North America is projected to hold the largest market share by the end of 2033. United States has the highest pet-dog population of 75.8 million. The population is very aware of their pets’ welfare. Stringent government laws are in place to protect animal rights. Rhode Island fully prohibits driving without restraining or properly harnessing the dog, and five other states in the US have some laws protecting dogs in vehicles to avoid accidents.

Market Segmentation

Our in-depth analysis of the global pet insurance market includes the following segments:

|

By Policy Coverage |

|

|

By Animal Type |

|

|

By Sales Channel |

|

Key Companies Dominating the Global Pet Insurance Market

Our report has covered detailed company profiling comprising company overview, business strategies, key product offerings, financial performance, key performance indicators, risk analysis, recent developments, regional presence, and SWOT analysis among other notable indicators for competitive positioning. Some of the prominent industry leaders in the global pet insurance market that are included in our report are American Modern Insurance Group, Inc. (Embrace Pet Insurance Agency, LLC), Figo Pet Insurance LLC., United States Fire Insurance Company (Hartville Group), Nationwide Pet Assure Corp., PetFirst Healthcare, LLC, ipet Insurance Co., Ltd., Pets Best Insurance Services, LLC.), RSA Insurance Group Limited (Royal & Sun Alliance), Trupanion Inc., and others.

Global Pet Insurance Market: Latest Developments

-

29th July 2022: Nationwide Pet Assure Corp.- The Pet Insurance Company has released its groundbreaking study - “Aging Well: Old Dogs, New Data (Part 1)” (PDF) at the American Veterinary Medical Association’s annual convention, which provides some clear guidelines around prevention, intervention, and veterinary care about various diseases affecting senior dogs.

-

3rd October 2022: ipet Insurance Co Ltd– The Company has announced that from 1st October 2022 just by showing the insurance card or My Page screen at the window of the animal hospital, one can avail his pet insurance on the spot, reducing the burden of medical expenses. There are 5688 facilities that support Ipet, where the facility can be used.

Key Reasons to Buy Our Report

-

The report covers detailed analysis comprising market share attained by each market segment and its sub-segments.

-

It covers market dynamics including growth drivers, trends, potential opportunities, price trend analysis and challenges that impact the market growth.

-

The report includes detailed company profiles of the major players dominating the market.

-

We use effective research methodologies to calculate the market numbers and provide value-added assessment for overall growth.

-

We provide customized reports as per the clients’ requirement helping them to see possible and unexpected challenges and unforeseen opportunities in order to help them reach their goal.

Geography Analysis:

The report further discusses the market opportunity, compound annual growth rate (CAGR) growth rate, competition, new technology innovations, market players analysis, government guidelines, export and import (EXIM) analysis, historical revenues, future forecasts etc. in the following regions and/or countries:

- North America (U.S. & Canada) Market Size, Y-O-Y Growth, Market Players Analysis & Opportunity Outlook

- Latin America (Brazil, Mexico, Argentina, Rest of Latin America) Market Size, Y-O-Y Growth & Market Players Analysis & Opportunity Outlook

- Europe (U.K., Germany, France, Italy, Spain, Hungary, Belgium, Netherlands & Luxembourg, NORDIC(Finland, Sweden, Norway, Denmark), Ireland, Switzerland, Austria, Poland, Turkey, Russia, Rest of Europe), Poland, Turkey, Russia, Rest of Europe) Market Size, Y-O-Y Growth Market Players Analys & Opportunity Outlook

- Asia-Pacific (China, India, Japan, South Korea, Singapore, Indonesia, Malaysia, Australia, New Zealand, Rest of Asia-Pacific) Market Size, Y-O-Y Growth & Market Players Analysis & Opportunity Outlook

- Middle East and Africa (Israel, GCC (Saudi Arabia, UAE, Bahrain, Kuwait, Qatar, Oman), North Africa, South Africa, Rest of Middle East and Africa) Market Size, Y-O-Y Growth Market Players Analysis & Opportunity Outlook

.

FREQUENTLY ASKED QUESTIONS

The growing number of pet population across the world, increasing cost of their medical expenditure and awareness regarding the benefits of pet insurance are some of the factors driving the growth of the pet insurance market.

The market is anticipated to attain a CAGR of ~15% over the forecast period, i.e., 2023 – 2033.

Lack of awareness regarding pet insurance, high premium on the policy, and detailed formalities are some of the challenges affecting market growth.

The market in North America is projected to hold the largest market share by the end of 2033 and provide more business opportunities in the future.

The major players in the market are American Modern Insurance Group, Inc. (Embrace Pet Insurance Agency, LLC), Figo Pet Insurance LLC., United States Fire Insurance Company (Hartville Group), Nationwide, Pet Assure Corp., PetFirst Healthcare, LLC, ipet Insurance Co., Ltd., Pets Best Insurance Services, LLC., RSA Insurance Group Limited (Royal & Sun Alliance), Trupanion Inc., and others.

The company profiles are selected based on the revenues generated from the product segment, geographical presence of the company which determine the revenue generating capacity as well as the new products being launched into the market by the company.

The market is segmented by policy coverage, animal type, sales channel and by region.

The accident and illness sub segment is anticipated to garner the largest market size by the end of 2033 and display significant growth opportunities.

Please enter your personal details below

- American Modern Insurance Group Inc

- Embrace Pet Insurance Agency LLC

- Figo Pet Insurance LLC.

- United States Fire Insurance Company (Hartville Group)

- Nationwide Pet Assure Corp.

- PetFirst Healthcare LLC

- ipet Insurance Co. Ltd.

- Pets Best Insurance Services LLC.

- RSA Insurance Group Limited (Royal & Sun Alliance)

- Trupanion Inc.