Global Construction Insurance Market Size study, Type (Professional Liability and Property and Casualty), Application (Agency, Bancassurance and Digital & Direct Channels) and Regional Forecasts 2019-2026

-

Product Code:

RP-ID-10306388 -

Published Date:

21 Oct 2022 -

Region:

Global

-

Pages:

200 -

Category:

Building & Constructions -

Publisher:

Pub-ID-14

Impact Analysis on the Growth of Market

Inflation and Looming Recession to Haunt Businesses:

In 2022 & 2023, market players expected to sail in rough waters; might incur losses due to huge gap in currency translation followed by contracting revenues, shrinking profit margins & cost pressure on logistics and supply chain. Further, U.S. economy is expected to grow merely by 3% in 2022.

....

The Research Report is Updated with 2022 Base Year, 2023 Estimated year and Forecast till 2035 with Market Insights.

With the dip in global production, the GDP has contracted in 2020 and impacted the market across the world. Upon placing a Sample Request, you will receive an updated report with 2022 as base year, 2023 as estimated year and forecast to 2035. This will have market drivers, recovery rate in the market, insights and competitive analysis.

Market Overview:

Translate Report

Global Construction Insurance market is valued approximately at USD XX Billion in 2018 and is anticipated to grow with a growth rate of more than XX% over the forecast period 2019-2026. Construction insurance is an insurance that offers financial protection for the risks caused by a building or structure and unexpected incidents that result in damages and injuries during the building of a building. Construction companies or other people who have an interest in the property that is being constructed usually buy the house. Construction projects are often highly costly projects with specific risk levels. Without building compensation, this project will be extremely costly for businesses to join. Increasing construction projects across different geographies would demand higher adoption of construction insurance in the coming years. For instance, as per the World Economic Forum (WEF) report in 2016, China spends 8.3% of country’s GDP in infrastructure projects followed by 5.6% in India, 4.4% in Australia and others. Thus, rising construction projects and government spending in construction sector would positively affect the market growth in the coming years.

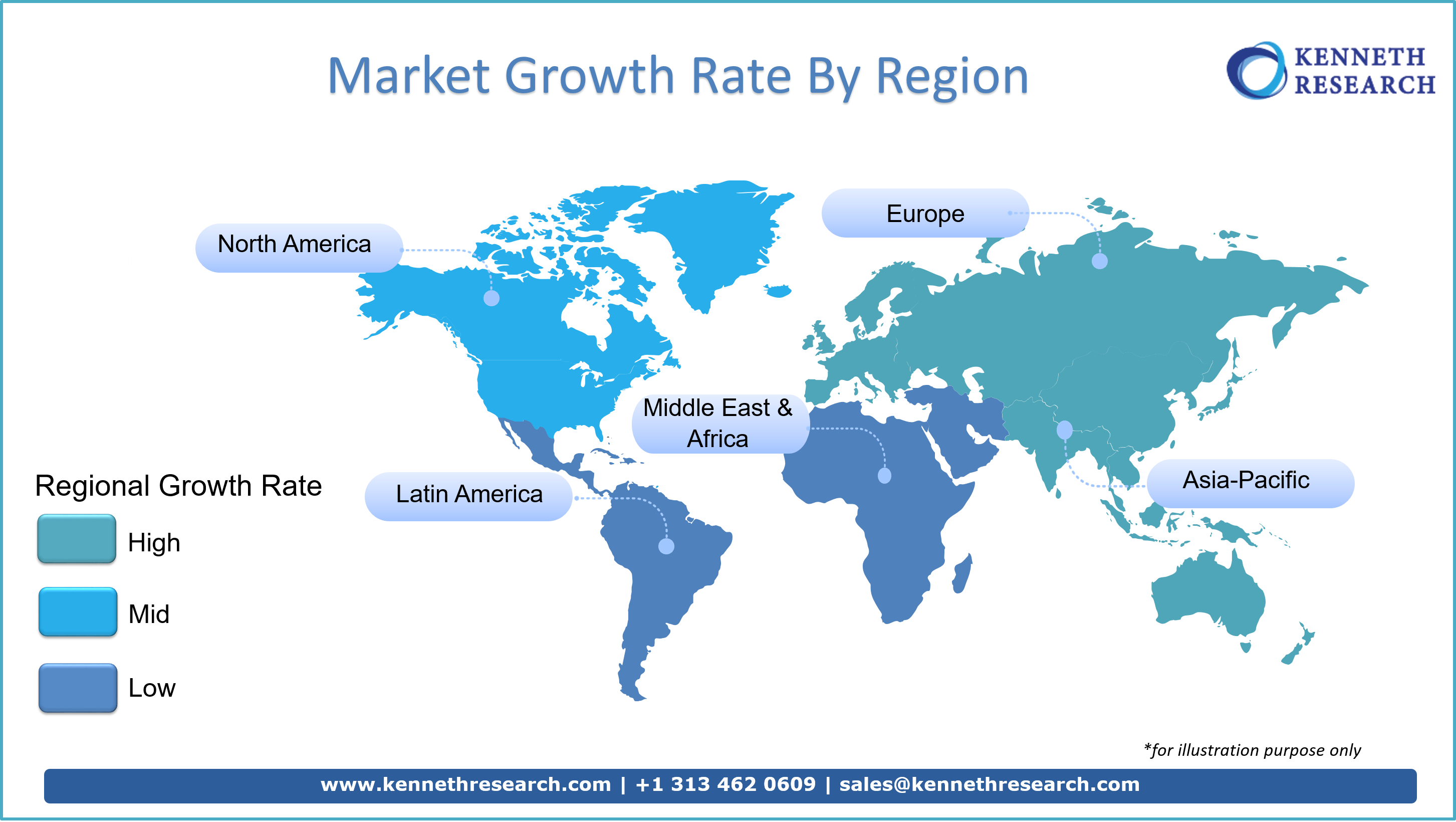

The regional analysis of global Construction Insurance market is considered for the key regions such as Asia Pacific, North America, Europe, Latin America and the Rest of the World. North America is the leading region in terms of revenue for the construction insurance market. Additionally, Asia-Pacific is expected to grow at highest CAGR in the coming years.

Market player included in this report are:

Allianz

AIG

Tokio Marine

ACE & Chubb

XL group

QBE

Zurich Insurance

AXA

Beazley

Munich RE

The objective of the study is to define market sizes of different segments & countries in recent years and to forecast the values to the coming eight years. The report is designed to incorporate both qualitative and quantitative aspects of the industry within each of the regions and countries involved in the study. Furthermore, the report also caters the detailed information about the crucial aspects such as driving factors & challenges which will define the future growth of the market. Additionally, the report shall also incorporate available opportunities in micro markets for stakeholders to invest along with the detailed analysis of competitive landscape and product offerings of key players. The detailed segments and sub-segment of the market are explained below:

By Type:

Professional Liability

Property and Casualty

By Application:

Agency

Bancassurance

Digital & Direct Channels

By Regions:

North America

U.S.

Canada

Europe

UK

Germany

Asia Pacific

China

India

Japan

Latin America

Brazil

Mexico

Rest of the World

Furthermore, years considered for the study are as follows:

Historical year – 2016, 2017

Base year – 2018

Forecast period – 2019 to 2026

Target Audience of the Global Construction Insurance Market in Market Study:

Key Consulting Companies & Advisors

Large, medium-sized, and small enterprises

Venture capitalists

Value-Added Resellers (VARs)

Third-party knowledge providers

Investment bankers

Investors

Geography Analysis:

The report further discusses the market opportunity, compound annual growth rate (CAGR) growth rate, competition, new technology innovations, market players analysis, government guidelines, export and import (EXIM) analysis, historical revenues, future forecasts etc. in the following regions and/or countries:

- North America (U.S. & Canada) Market Size, Y-O-Y Growth, Market Players Analysis & Opportunity Outlook

- Latin America (Brazil, Mexico, Argentina, Rest of Latin America) Market Size, Y-O-Y Growth & Market Players Analysis & Opportunity Outlook

- Europe (U.K., Germany, France, Italy, Spain, Hungary, Belgium, Netherlands & Luxembourg, NORDIC(Finland, Sweden, Norway, Denmark), Ireland, Switzerland, Austria, Poland, Turkey, Russia, Rest of Europe), Poland, Turkey, Russia, Rest of Europe) Market Size, Y-O-Y Growth Market Players Analys & Opportunity Outlook

- Asia-Pacific (China, India, Japan, South Korea, Singapore, Indonesia, Malaysia, Australia, New Zealand, Rest of Asia-Pacific) Market Size, Y-O-Y Growth & Market Players Analysis & Opportunity Outlook

- Middle East and Africa (Israel, GCC (Saudi Arabia, UAE, Bahrain, Kuwait, Qatar, Oman), North Africa, South Africa, Rest of Middle East and Africa) Market Size, Y-O-Y Growth Market Players Analysis & Opportunity Outlook

.

Please enter your personal details below

AIG

Tokio Marine

ACE & Chubb

XL group

QBE

Zurich Insurance

AXA

Beazley

Munich RE