Global Fintech Market Analysis by Service Type (Loans, Insurance, Fund Transfers, Payment, Others); by Application (Securities, Insurance, Banking, and Others); and by Technology (Artificial Intelligence, Application Programming Interfaces, Blockchain, and Others)-Global Supply & Demand Analysis & Opportunity Outlook 2022-2031

Report ID: 10085128 |

Published Date: 21 Mar 2025 |

Report Format: |

Delivery Timeline: 48-72 Business Hours

Global Fintech Market Size, Forecast, and Trend Highlights Over 2022 - 2031

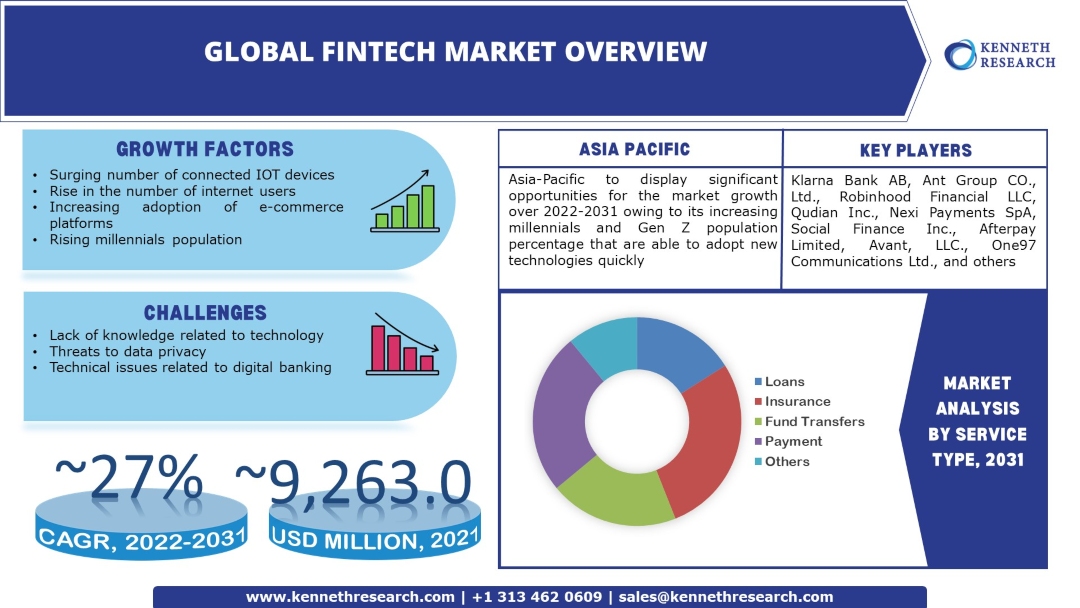

The global fintech market is estimated to garner a notable revenue by the end of 2031 by growing at a CAGR of ~27% over the forecast period, i.e., 2022 – 2031. Further, the market generated a revenue of ~USD 9,263.0 million in the year 2021. The growth of the market can be attributed to the increasing smartphone penetration across the globe. For instance, there are more than 6 million smartphone users worldwide in the year 2022.

GET A SAMPLE COPY OF THIS REPORT

Financial technology also known as Fintech, refers to the use of technology to improve traditional financial services, making them more secure, faster, and easier. There are three major applications of fintech in the form of securities, insurance, banking, and others. With the advancement in technology worldwide, people are opting for digital payments for financial services, online purchases, and others. Therefore, it is expected to surge the growth of the global fintech market. For instance, the digital payment penetration in the United States has reached nearly 75 percent in 2020.

Global Fintech Market: Growth Drivers and ChallengesGrowth Drivers

-

Surging Number of Connected IoT Devices – - It was discovered that the number of IoT connections increased by more than 8% in 2022, from 12.2 billion active endpoints in 2021 to more than 14 billion in 2022 globally.

-

Rising Millennials Population– With the improvement of new technologies, the younger generations are able to use them easily. Therefore, it is projected to boost the growth of the global fintech market. Millennials make up nearly 20 percent of the total population, representing 1.8 Billion across the globe in 2021.

-

Increasing Adoption of E-Commerce Platforms– E-commerce platforms create their own payment solutions and it is anticipated to rise the growth of the global fintech market. Retail e-commerce sales in the year 2020 grew by approximately 25 percent.

-

Rise in the Number of Internet Users- The Internet is important for dealing in financial services as a service provider or service receiver. Therefore, it is expected to surge the growth of the global fintech market. According to the World Population Review, only 6% of the global population, or 361 million people, used the internet in 2000, whereas by 2022, 4.9 billion people, or 69% of the global population, will be actively using the internet. The trends show a 4% annual growth rate, implying that 196 million new people access the internet each year.

Challenges

-

Lack of Knowledge Related to Technology

-

Threats to Data Security

-

Technical Issues Related to Digital Banking

The global fintech market is segmented and analyzed for demand and supply by service type into loans, insurance, fund transfers, payment, and others Out of these, the insurance segment is anticipated to hold the largest share over the forecast period owing to the growth of the insurance industry, and increasing awareness among people related to insurance. For instance, there was a 7.2 percent average insurance penetration across the globe in the year 2019.

Global Fintech Market Regional Synopsis

Regionally, the global fintech market is studied into five major regions including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa region. Amongst these markets, the market in the Asia Pacific region is projected to hold the largest market share by the end of 2031 on the back of increasing millennial and Gen Z population percentages that have the highest capability to adopt new technology and digital payment solutions. For instance, more than 30 percent of the total population in India was millennials accounting for approximately 435 million in 2021.

Market Segmentation

Our in-depth analysis of the global fintech market includes the following segments:

|

By Service Type |

|

|

By Application |

|

|

By Technology |

|

Customize this Report: Request Customization

Key Companies Dominating the Global Fintech Market

Our report has covered detailed company profiling comprising company overview, business strategies, key product offerings, financial performance, key performance indicators, risk analysis, recent developments, regional presence, and SWOT analysis among other notable indicators for competitive positioning. Some of the prominent industry leaders in the global fintech market that are included in our report are Afterpay Limited, Avant, LLC., Qudian Inc., Nexi Payments SpA, Social Finance Inc., Robinhood Financial LLC, Klarna Bank AB, One97 Communications Ltd., Google Payment Corp. (Alphabet Inc.), Ant Group CO., Ltd., and others.

Global Fintech Market: Latest Developments

-

July, 2022: Nexi Payments SpA announced the partnership with Microsoft Corporation through innovating payment solutions and cloud transformation in digital payments across the European payment space.

-

April, 2022: Klarna Bank AB announced the completion of acquisition of PriceRunner in order to bring new features to the Klarna app globally through rich product discovery, product reviews, and price comparison to help consumers save money and time.

Key Reasons to Buy Our Report

-

The report covers a detailed analysis comprising market share attained by each market segment and its sub-segments.

-

It covers market dynamics including growth drivers, trends, potential opportunities, price trend analysis, and challenges that impact market growth.

-

The report includes detailed company profiles of the major players dominating the market.

-

We use effective research methodologies to calculate the market numbers and provide value-added assessments for overall growth.

-

We provide customized reports as per the clients’ requirement helping them to see possible and unexpected challenges and unforeseen opportunities in order to help them reach their goal.

Frequently Asked Question

The market is segmented by service type, application, technology, and by region.

The insurance segment is anticipated to garner the largest market size by the end of 2031 and display significant growth opportunities.

Why Choose Kenneth Research ?

-

Insight with Impact : We don’t just gather data — we uncover stories, trends, and opportunities that fuel business growth.

-

Experts Who Get It : Our team speaks your industry’s language and knows what really matters to your customers and market.

-

Custom-Built for You : Forget one-size-fits-all. We craft research and consulting solutions as unique as your business vision.

-

Partners, Not Just Providers : We work with you, not for you — collaborating closely to turn insights into smart, strategic moves.

-

Results That Speak : Our work powers brands, startups, and industry leaders alike — with a track record of ideas that work in the real world.

Report ID: 10085128 |

Published Date: 21 Mar 2025 |

Report Format: |

Delivery Timeline: 48-72 Business Hours

More Reports from ICT & Telecom Sector

Thank you for contacting us!

We have received your sample request for the research report. Our research representative will contact you shortly.

Get Free Sample Report

Fintech Market

JUMP TO CONTENT