Global Fintech Market (2018-2023)

-

Product Code:

RP-ID-10084483 -

Published Date:

21 Oct 2022 -

Region:

Global

-

Pages:

89 -

Category:

Service Industry -

Publisher:

Pub-ID-13

Impact Analysis on the Growth of Market

Inflation and Looming Recession to Haunt Businesses:

In 2022 & 2023, market players expected to sail in rough waters; might incur losses due to huge gap in currency translation followed by contracting revenues, shrinking profit margins & cost pressure on logistics and supply chain. Further, U.S. economy is expected to grow merely by 3% in 2022.

....

The Research Report is Updated with 2022 Base Year, 2023 Estimated year and Forecast till 2035 with Market Insights.

With the dip in global production, the GDP has contracted in 2020 and impacted the market across the world. Upon placing a Sample Request, you will receive an updated report with 2022 as base year, 2023 as estimated year and forecast to 2035. This will have market drivers, recovery rate in the market, insights and competitive analysis.

Market Overview:

Translate Report

High usage of mobile devices and technology-based solutions is pushing the demand for financial and banking solutions, which can be accessed through personal devices. Banks and firms are investing heavily in technology-based solutions, competing with contemporary fintech companies. This is the key growth driver for the global fintech market, which will pin its worth at approximately USD 305.7 billion by 2023, at a CAGR of 22.17% during 2018-2023.

Service segment insights

The various services provided in the fintech sector are regtech, payment/billing, insurtech, money transfer/remittance, mortgage/real estate, and others (lending, capital market, wealth management). Among these segments, the payment/billing services segment is expected to drive major growth in the global market, leading to a revenue generation of USD 207.11 Bn by 2023. This growth can be attributed to contactless cards and the emergence of retail-focused fintech companies looking to expand the use of this functionality by taking it to every corner of commerce. The popularity of payment apps like GoUrl, Cayan, Stripe, and Amazon Pay amongst customers and retailers will further drive the market. Regtech is also expected to grow extensively at a CAGR of 22.05%, after payment/billing. This is mainly due to the advent of new regulations pertaining to Fintech sector.

Technology segment insights

Major technologies involved in the fintech sector are artificial intelligence (AI), blockchain, cryptography, biometrics and identity management, cyber-security, and robotic process automation (RPA). Significant growth will be witnessed in areas of AI and blockchain, attracting major investments during the forecast period, 2018-2023. AI interfaces and chatbots have primarily redefined customer service, and its growing popularity will enable AI-oriented fintech market to expand at a CAGR of 21.72% during 2018-2023, followed by blockchain-based fintech companies.

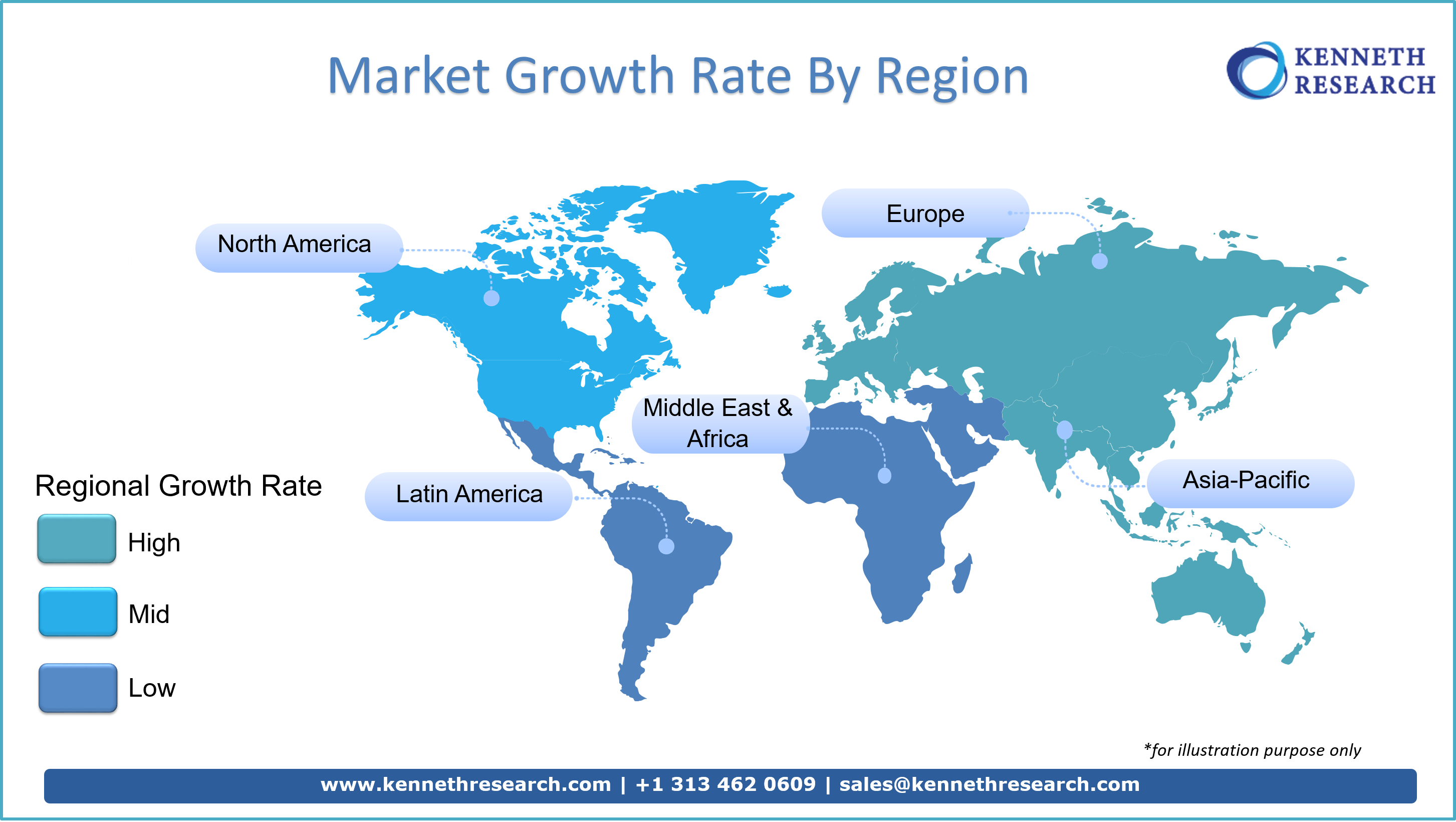

Regional insights

North America is the leading contributor to the global fintech market and is expected to reach USD 80.85 Bn by 2023. However, the pace of growth in the Asia-Pacific (APAC) region is anticipated to be the highest, at a CAGR of 43.34% during 2018-2023. The growth can be attributed to an increasing number of start-ups catering to most of the financial areas, including banking, insurance and wealth management. China, Japan, South Korea, Australia, and India are the key contributing countries. Latin America, on the other hand, is slowly emerging as one of the prominent regions in terms of fintech development, majorly driven by initiatives in Mexico and Brazil.

Companies covered

• Robinhood

• Ant Financial

• Paytm

• Shanghai Lujiazui International Financial Asset Exchange

• Oscar Insurance Corporation

• Credit Karma

• Kabbage

• Atom Bank

• Onfido

• Uipath

Customizations available:

With the given market data, Research On Global Markets offers customizations according to specific needs. Write to us at sales@kennethresearch.com, or connect with us here.

Geography Analysis:

The report further discusses the market opportunity, compound annual growth rate (CAGR) growth rate, competition, new technology innovations, market players analysis, government guidelines, export and import (EXIM) analysis, historical revenues, future forecasts etc. in the following regions and/or countries:

- North America (U.S. & Canada) Market Size, Y-O-Y Growth, Market Players Analysis & Opportunity Outlook

- Latin America (Brazil, Mexico, Argentina, Rest of Latin America) Market Size, Y-O-Y Growth & Market Players Analysis & Opportunity Outlook

- Europe (U.K., Germany, France, Italy, Spain, Hungary, Belgium, Netherlands & Luxembourg, NORDIC(Finland, Sweden, Norway, Denmark), Ireland, Switzerland, Austria, Poland, Turkey, Russia, Rest of Europe), Poland, Turkey, Russia, Rest of Europe) Market Size, Y-O-Y Growth Market Players Analys & Opportunity Outlook

- Asia-Pacific (China, India, Japan, South Korea, Singapore, Indonesia, Malaysia, Australia, New Zealand, Rest of Asia-Pacific) Market Size, Y-O-Y Growth & Market Players Analysis & Opportunity Outlook

- Middle East and Africa (Israel, GCC (Saudi Arabia, UAE, Bahrain, Kuwait, Qatar, Oman), North Africa, South Africa, Rest of Middle East and Africa) Market Size, Y-O-Y Growth Market Players Analysis & Opportunity Outlook

.

Please enter your personal details below

1. Robinhood

2. Ant Financial

3. Paytm

4. Shanghai Lujiazui International Financial Asset Exchange

5. Oscar Insurance Corporation

6. Credit Karma

7. Kabbage

8. Atom Bank

9. Onfido

10. Uipath