China Safe Cities Technologies And Markets – 2013-2022

-

Product Code:

RP-ID-10073340 -

Published Date:

21 Oct 2022 -

Region:

Global

-

Pages:

574 -

Category:

Aerospace & Defence -

Publisher:

Pub-ID-22

Impact Analysis on the Growth of Market

Inflation and Looming Recession to Haunt Businesses:

In 2022 & 2023, market players expected to sail in rough waters; might incur losses due to huge gap in currency translation followed by contracting revenues, shrinking profit margins & cost pressure on logistics and supply chain. Further, U.S. economy is expected to grow merely by 3% in 2022.

....

The Research Report is Updated with 2022 Base Year, 2023 Estimated year and Forecast till 2035 with Market Insights.

With the dip in global production, the GDP has contracted in 2020 and impacted the market across the world. Upon placing a Sample Request, you will receive an updated report with 2022 as base year, 2023 as estimated year and forecast to 2035. This will have market drivers, recovery rate in the market, insights and competitive analysis.

Market Overview:

Translate Report

In 2011, the Chinese central government began the massive implementation of a national program requiring 650 Chinese cities to reform their public security and safety infrastructures with state-of-the-art technologies. According to the China Safe Cities Technologies and Markets 2013-2022 report, this program will result in a cumulative 2013-2022 $138 billion Chinese Safe City market the largest national Safe City market in the world.

Foreign-based companies (e.g., Cisco, IBM, GE Security Asia, Panasonic, Samsung Electronics, Bosch Security, Honeywell, Siemens, Toshiba, AGT) will continue to dominate the Safe Cities premium/high-end product markets while the low and mid-end products will be supplied by Chinese vendors. The foreign-based companies’ market share is estimated at more than 35%, representing cumulative revenues of $46 billion for the forecasted period.

A major driver of the market is that China is pushing ahead with its massive multi-trillion dollar plan to transfer 250 million rural residents (roughly the total urban population of the U.S.) into newly-constructed cities. The goal of this plan is to decisively solve the rural-urban income gap by creating a prospering urban middle class of over 700 million people. This urbanization will supply a low cost workforce and create a growing consumer demand for goods and services. Thus, this program is viewed as the key to maintaining the nation’s continued economic development. This massive relocation is generating harsh opposition requiring the Chinese government to go to extreme ends to maintain control of the process. The government is committed to spending tens of billions on high-end technologies to ensure the safety and security of their cities.

As the Great Wall of China was built to defend the country from its external enemies, the Safe Cities program is being built to defend China from internal threats (e.g., crime, terror, manmade and natural disasters). Accordingly, hundreds of Chinese cities are rushing to construct their safe city platforms by fusing internet, video surveillance cameras, cell phones, GPS location data and biometric technologies into central ICT meta-systems.

The following are a few examples of Chinese Safe City projects:

Sichuan Province is spending $4.2 billion on its safe city project including a network of 500,000 surveillance cameras.

The Guangdong Province Safe City Corridor project will be based on a 1,000,000 cameras surveillance system at an estimated cost of over $6 billion.

The Beijing municipal government is seeking to place cameras in all entertainment venues, adding 400,000 surveillance cameras to the bundle of 300,000 cameras that were installed for the 2008 Olympics.

Urumqi, the capital of Xinjiang, where almost 200 people died in the July 2009 riots, finished the installation of 40,000 surveillance cameras as part of an ongoing safe city project.

The Safe City project of Guangzhou, one of the main export and manufacturing hubs, will include 270,000 surveillance cameras

The China Safe City Technologies & Market 2013-2022 report, segmented into dozens of sub-markets, offers for each submarket 2011-2013 data, analysis & foreign-based vendors market share and 2014-2022 forecasts, analysis & foreign-based vendors market share. In 574 pages, 43 tables and 103 figures, the report analyzes and projects the market and technologies from several perspectives, including:

Market forecast by submarket, including tracking technologies, video surveillance, C2/C4ISR , physical identity & access management, managed security services, physical security information management, location-based emergency notification, consulting & planning, cyber security, public safety communications, system integration.

Current and pipeline technologies, including: Physical Security Information Management (PSIM), Public-safety answering point (PSAP), Sensor Network ICT Systems, Wireless Sensor Networks, Software as a Service (SaaS), Emergency Response use of Social Media, Geographic Information System (GIS), Location Based Emergency Mass Notification Systems (EMNS), Cell Broadcast, Cell Information Technology, Managed Security Services (MSS), Sensor and Data Fusion Algorithms, Safe City Communication and Infrastructure, Video Surveillance Technologies, Intelligent Video Surveillance (IVS) Technologies (Cloud Platforms, Behavioral Analyses, Video Surveillance as a Service (VSaaS), Real Time Automatic Alerts Software, Image Segmentation Software, Item Tracking Intelligent CCTV Surveillance Software, Object Sorting and ID, Item Identification and Recognition, IVS Based Face Recognition, License Plate Recognition (LPR), Sorting Actions and Behaviors, Crowd Surveillance, Multi-camera Intelligent CCTV Surveillance Systems, Video Content Analysis, Behavioral Profiling, Tag and Track, Kalman Filtering Techniques, Region Segmentation), Partially Observable Markov Decision Process, ‘Splitting’ items Algorithms, Dimension Based Items Classifiers, Shape Based Item Classifiers, Event Detection Methods, Vision-based Human Action Recognition, 3D Derived Egomotion, Path Reconstruction Software, Video Cameras Spatial Gap Mitigation Software, Networked Cameras Tag and Track Software, Smart Cameras, Physical Identity and Access Management (PIAM), Flood Prediction Software, Gunshot Identification and Location Systems.

Business opportunities

Competitive analysis

79 major vendors (their profiles, products, Safe City activities and contact info): 3i-MIND, 3VR, 3xLOGIC, ABB, Accenture, ACTi Corporation, ADT Security Services, Agent Video Intelligence, AGT international, Alcatel, ALPHAOPEN, Anixter, Aralia System, Avigilon Corporation, Axis, AxxonSoft, BAE Systems, Bosch Security Systems, Briefcam, BRS Labs, BT, Camero, Cantronic Systems Inc., CelPlan, China Security & Surveillance, Inc., Cisco, Citilog, Diebold, DVTel, Elsag Datamat, Emerson Electric, Firetide, G4S, General Electric, Honeywell, IBM, IndigoVision, Intergraph Corporation, IntuVision Inc, Ioimage, iOmniscient, IPConfigure, IPS Intelligent Video Analytics, ISS, MACROSCOP, Mate Intelligent Video Ltd., MDS, Mer group, Milestone Systems A/S, Mirasys, Mobotix, National instruments, NetPosa Technologies, Ltd., NICE Systems, Northrop Grumman Corporation, ObjectVideo, Orsus, Panasonic, Pelco, Pivot3, Proximex, Raytheon Company, Salient Stills, Samsung Techwin, Schneider Electric, SeeTec, Siemens, Smart China (Holdings) Limited, Sony, Synectics, Tandu Technologies & Security Systems Ltd, Texas Instruments, Thales Group, TotalRecall, Unisys, Verint, Vigilant Systems, WeCU Technologies Ltd, Zhejiang Dahua Technology.

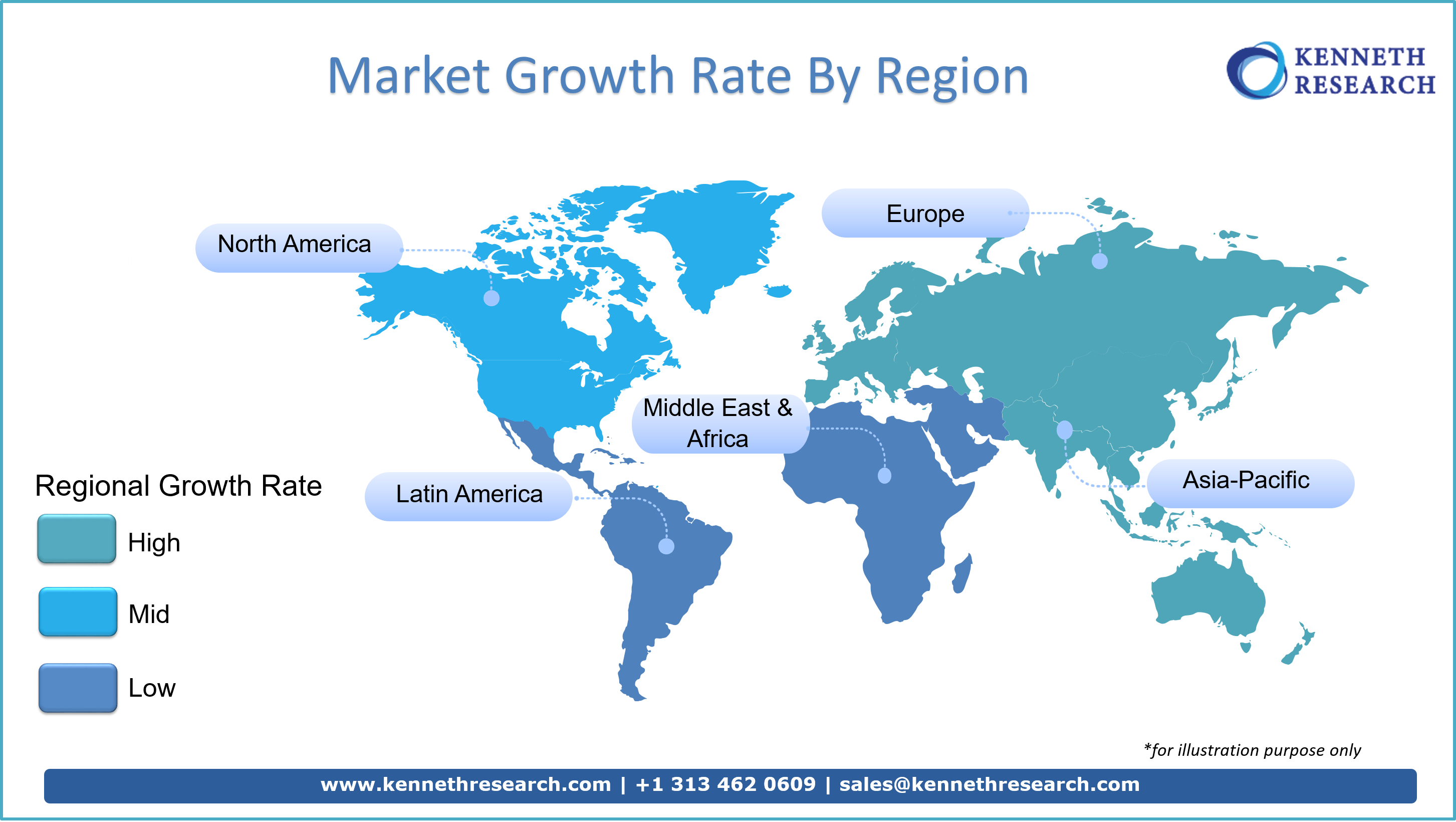

Geography Analysis:

The report further discusses the market opportunity, compound annual growth rate (CAGR) growth rate, competition, new technology innovations, market players analysis, government guidelines, export and import (EXIM) analysis, historical revenues, future forecasts etc. in the following regions and/or countries:

- North America (U.S. & Canada) Market Size, Y-O-Y Growth, Market Players Analysis & Opportunity Outlook

- Latin America (Brazil, Mexico, Argentina, Rest of Latin America) Market Size, Y-O-Y Growth & Market Players Analysis & Opportunity Outlook

- Europe (U.K., Germany, France, Italy, Spain, Hungary, Belgium, Netherlands & Luxembourg, NORDIC(Finland, Sweden, Norway, Denmark), Ireland, Switzerland, Austria, Poland, Turkey, Russia, Rest of Europe), Poland, Turkey, Russia, Rest of Europe) Market Size, Y-O-Y Growth Market Players Analys & Opportunity Outlook

- Asia-Pacific (China, India, Japan, South Korea, Singapore, Indonesia, Malaysia, Australia, New Zealand, Rest of Asia-Pacific) Market Size, Y-O-Y Growth & Market Players Analysis & Opportunity Outlook

- Middle East and Africa (Israel, GCC (Saudi Arabia, UAE, Bahrain, Kuwait, Qatar, Oman), North Africa, South Africa, Rest of Middle East and Africa) Market Size, Y-O-Y Growth Market Players Analysis & Opportunity Outlook

.