United States (U.S.) Standalone 5G Network Market Size & Share, by Component, Spectrum, Network, Vertical – Macroeconomic Analysis, Growth Trends, Top Companies, Forecast Report 2026-2035

Report ID: 1001 |

Published Date: 05 Nov 2025 |

Report Format: |

Delivery Timeline: 48-72 Business Hours

U.S. Standalone 5G Network Market Outlook:

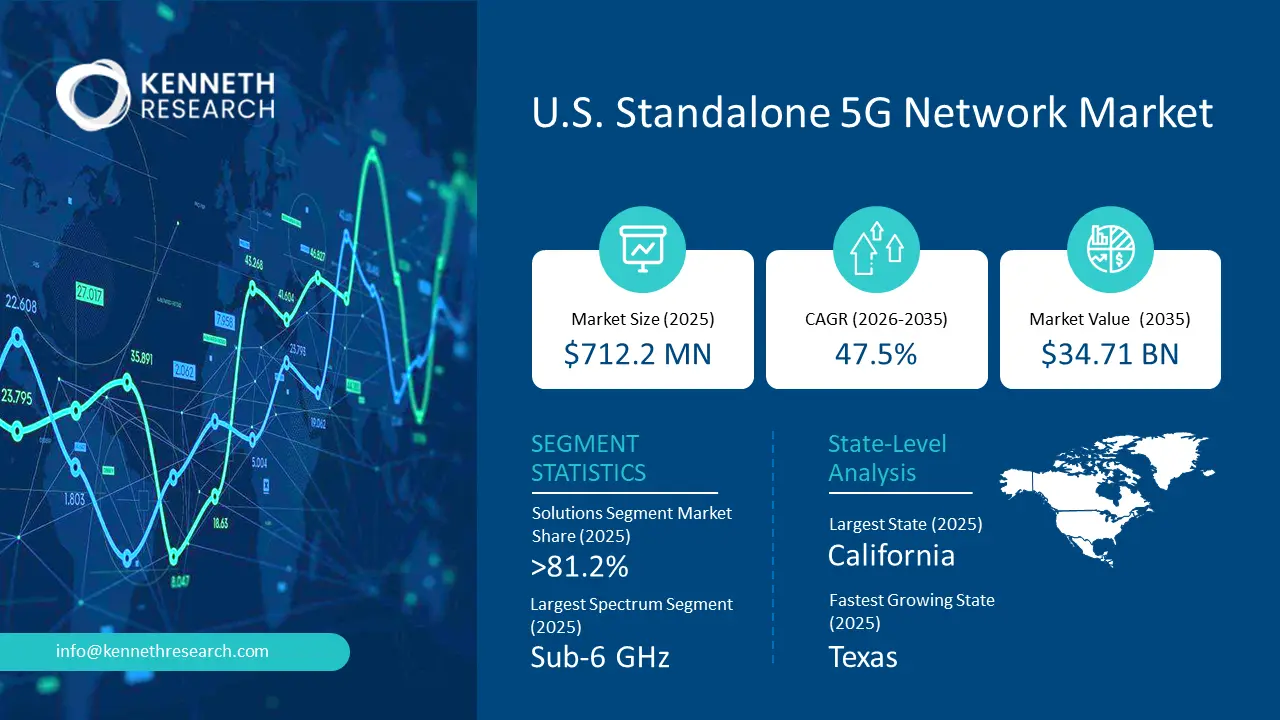

U.S. Standalone 5G Network Market size was valued at over USD 712.2 million in 2025 and is projected to cross USD 34.71 billion by 2035, expanding at 47.5% CAGR during 2026-2037. In 2026, the industry size is estimated at USD 1.03 billion.

U.S. Standalone 5G Network Market Growth & Challenges Trends –

U.S. Market Growth Trends:

- Rapid operator migration to SA: Standalone (SA) 5G has moved from trials into large-scale operator rollouts in the U.S., and that migration is reshaping demand by converting network-level investment into commercial services and new revenue streams. Operators’ moves to deploy a virtualized 5G core and re-farm spectrum eliminate the dependence on 4G signaling (NSA), enabling lower latency, improved throughput consistency, and cloud-native network functions that support more sophisticated service models (network slicing, edge-hosted applications). That technical shift raises demand for SA-capable radios, cloud-native core software, orchestration stacks, and integration services while also forcing device and SIM ecosystem updates — creating commercial demand across equipment vendors, system integrators, and enterprise solution providers.

- Enterprise & private network adoption: Demand for United States standalone 5G network market is increasingly driven by enterprises seeking private networks, industrial automation, and campus-scale connectivity with predictable SLAs — use cases that NSA cannot reliably deliver. SA’s virtualized core, combined with localized edge compute and network slicing, enables deterministic performance, security controls, and integration with operational technology (OT) systems — all required for manufacturing automation, logistics, ports, utilities, and public-sector sites. This is shifting spend from general consumer connectivity to bespoke, solution-oriented projects (systems integration, security, private-network provisioning, managed services), and it is creating partnerships between carriers, equipment vendors, cloud providers, and systems integrators. Real-world traction includes carriers and vendors winning industrial and public-sector private-5G contracts and joint go-to-market offers.

- Low-latency apps & edge/cloud convergence: The maturation of SA 5G crystallizes demand for low-latency, edge-native applications (industrial control loops, AR/VR collaboration, cloud gaming, real-time analytics) because SA enables full control over user plane placement and faster on-ramps to edge compute. That capability is driving enterprises and developers to re-architect applications to exploit edge compute and network slices, increasing demand for edge data centers, MEC (multi-access edge compute) platforms, orchestration tooling, and developer ecosystems (APIs, SDKs, marketplaces). At the same time, application providers and cloud firms must tackle operational complexity — orchestration across distributed edges, security at scale, and portability — which stimulates innovation in orchestration, observability, and developer tooling. Industry players are responding by building edge partnerships, platform integrations, and developer programs to lower adoption barriers.

U.S. Market Challenges –

- High deployment cost & unclear monetization: Operators and infrastructure providers in the U.S. standalone 5G network market face a dual strain: steep capital/operational investment and comparatively ambiguous revenue take-off. Migrating to a standalone 5G architecture – with a cloud-native core, network slicing, edge compute integration – involves significant system redesign, vendor coordination, spectrum re-planning and legacy upgrade work. At the same time, many of the promised “killer” 5G SA use-cases (ultra-low latency industrial automation, massive IoT, network-sliced enterprise services) remain emergent or pilot-phase rather than widespread. For example, analysts note that many U.S. operators are hesitant because the business case for SA remains uncertain. Further, a report by PwC stressed that network-costs for advanced 5G applications can run several multiples higher than standard mobile connectivity, while revenue extractable from those applications is constrained.

- Spectrum constraints & ecosystem readiness: The advancement of standalone 5G network in the U.S. is materially influenced by spectrum availability (especially mid-band) and an ecosystem of devices, standards, and supporting technologies that can fully exploit SA’s capabilities. The U.S. ecosystem faces regulatory and allocation complexities: a key bottleneck is the slow pace of releasing additional licensed mid-band spectrum (3–5 GHz) for commercial use, given incumbent federal uses and inter-agency processes. Without adequate contiguous, harmonised mid-band spectrum, operators struggle to optimize coverage and capacity for standalone 5G network, which in turn impacts business case, device ecosystem size, and global equipment economics. Further, SA-ready devices, network slicing standards, enterprise integration tools and edge-compute orchestration are still maturing. For SA to deliver its full value (e.g., low latency, slicing, URLLC) the ecosystem must be in place.

U.S. Standalone 5G Network Market Size and Forecast:

| Report Attribute | Details |

|---|---|

| Base Year |

2025 |

| Forecast Year |

2026-2035 |

| CAGR |

47.5% |

| Base Year Market Size (2025) |

USD 712.2 million |

| Forecast Year Market Size (2035) |

USD 34.71 billion |

United States Standalone 5G Network Market Opportunities –

Private & enterprise network expansion

Stand-alone 5G enables organisations — for example in manufacturing, logistics, utilities, port operations, campus or venue settings — to deploy private or dedicated wireless networks with high reliability, low latency and predictable service levels. That opens new revenue streams beyond mass-consumer mobile connectivity: carriers, equipment vendors, system integrators and cloud/edge players can all participate in delivering and managing private SA networks for enterprises.

For example, the municipal utility Memphis Light, Gas & Water recently selected Nokia to deploy a full-scale standalone 5G private network for grid-modernisation in the U.S. — underlining the uptake of SA in non-telecom verticals. Also, industry commentary notes the momentum of private 5G networks and edge/industrial use cases in the U.S. as a key differentiator.

Edge-native applications & low-latency services

The migration to 5G SA unlocks not just faster speeds but new capabilities around ultra-low latency, high device density and network slicing — which in turn enable edge-native and real-time applications (such as augmented reality (AR)/virtual reality (VR), autonomous mobile robots (AMRs), advanced analytics on the factory floor, or immersive entertainment). For example, the website of Verizon Business highlights how 5G plus edge computing can support use cases like cashierless checkout in retail, AR overlays for maintenance, factory material-scan video analytics and real-time robotics. Moreover, research notes that 5G SA is required to enable network slicing and tailored connectivity for such advanced use cases.

Network slicing and differentiated service tiers

With a fully deployed 5G SA core, operators can create logical network “slices” — each tailored with specified latency, bandwidth, security and device-type characteristics — thereby enabling premium or differentiated services rather than “one-size-fits-all” mobile connectivity. This presents an opportunity for operators and ecosystem partners to monetise connectivity in new ways (e.g., dedicated slices for first-responders, enterprise IoT, live-event broadcasting, premium consumer services). For example, T‑Mobile US offers network slicing to business customers: their site states that the slicing capability is built on its 5G SA network, supporting developers with a “slice of the network” to drive video calling and other performance-sensitive applications. Furthermore, industry analysis emphasises that slicing is a transformational capability made possible only by SA networks

U.S. Standalone 5G Network Market Segmentation -

The solutions segment maintains a dominant position in the United States standalone 5G network market with 81.25% revenue share in 2025, due to its comprehensive offerings that integrate hardware, software, and service layers into deployable packages. This segment allows operators and enterprises to implement full-scale 5G standalone networks efficiently, reducing operational complexity and accelerating deployment timelines. Factors driving its leadership include the rising demand for cloud-native cores, network orchestration platforms, and managed services that ensure reliable performance across public and private networks. Leading companies such as Verizon, AT&T, and Nokia actively contribute to this growth by offering end-to-end SA 5G solutions, including private network setups and managed edge computing services, enabling enterprises to adopt advanced connectivity without significant in-house technical burden. The segment’s dominance reflects a synergy of technological readiness, streamlined deployment capabilities, and strong industry adoption trends.

The sub-6 GHz spectrum segment in the U.S. standalone 5G market accounted for largest share in 2025, because it provides an optimal balance of coverage and capacity, making it suitable for wide-area deployments and enterprise applications. Unlike mmWave bands, sub-6 GHz enables reliable connectivity across urban, suburban, and industrial sites without extensive infrastructure densification, which is critical for both public and private 5G networks. Companies like T-Mobile have emphasized their use of sub-6 GHz SA networks to deliver nationwide 5G services that support low-latency enterprise applications and consumer connectivity alike. The segment’s leadership is also supported by regulatory spectrum allocation policies that prioritize sub-6 GHz bands for commercial use, ensuring easier deployment and lower complexity compared to higher-frequency alternatives. Businesses can capitalize on this by focusing on solutions optimized for sub-6 GHz, which balance performance with practical deployment feasibility.

The public network segment leads the market as operators focus on providing large-scale 5G coverage to consumers, businesses, and public institutions. Public networks are critical for realizing the commercial promise of 5G standalone technology, as they enable mass adoption, service monetization, and nationwide connectivity. U.S. carriers such as Verizon and AT&T are actively expanding SA deployments across urban and suburban areas, promoting services that include enhanced mobile broadband and enterprise-ready network slices. The segment’s leadership is reinforced by growing consumer demand for faster speeds, low-latency applications, and the ability to support multiple connected devices in public environments. Organizations can leverage this trend by developing applications and services that rely on widespread public SA network coverage, including mobile edge computing and IoT-enabled public services.

The manufacturing segment dominates the U.S. standalone 5G network market among enterprise verticals due to the strong adoption of SA 5G networks for industrial automation, smart factories, and connected operations. Standalone 5G provides deterministic performance, network slicing, and ultra-low latency required for robotics, automated guided vehicles (AGVs), and real-time monitoring systems on factory floors. Companies like Nokia and Ericsson, in partnership with U.S. industrial operators, are actively deploying private SA networks and edge-enabled solutions tailored for manufacturing environments. Leadership in this segment is driven by the convergence of operational efficiency demands, regulatory support for industrial digitalization, and the need to integrate OT and IT systems securely and efficiently. Enterprises can benefit by implementing SA-enabled smart factory solutions that improve productivity, predictive maintenance, and supply chain visibility.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegment |

|

Component |

|

|

Spectrum |

|

|

Network |

|

|

Vertical |

|

State-Level Analysis for U.S. Standalone 5G Network Market:

California: Largest State in U.S. Standalone 5G Market

California stands as the largest state in the U.S. standalone 5G network market, driven by its robust technology sector, significant industrial base, and supportive regulatory environment. The state's concentration of tech giants like Apple, Google, and Qualcomm fosters innovation and accelerates the adoption of advanced network technologies. California's commitment to digital infrastructure is evident through initiatives such as the California Public Utilities Commission's efforts to streamline permitting processes for 5G deployments, facilitating faster and more efficient network rollouts. Additionally, the state's diverse industries, including entertainment, healthcare, and manufacturing, create a high demand for reliable and high-speed connectivity, further propelling the growth of standalone 5G networks.

Texas: Fastest-Growing State in U.S. Standalone 5G Network Market

Texas is emerging as the fastest-growing state in the United States (U.S.) standalone 5G network market, fueled by rapid urbanization, a thriving economy, and proactive state policies. Cities like Austin and Dallas are becoming hubs for tech startups and innovation, attracting investments in next-generation network infrastructure. The Texas Department of Information Resources has implemented programs to accelerate broadband expansion, including 5G, in underserved areas, ensuring equitable access to advanced connectivity. Moreover, the state's strong presence in industries such as energy, logistics, and education drives the demand for secure and high-performance private 5G networks, positioning Texas as a leader in the nationwide 5G transformation.

U.S. Standalone 5G Network Market - Competitive Landscape

Established Telecom Giants

AT&T continues to be a significant force in the U.S. 5G market. The company has made substantial investments to enhance its 5G capabilities, including a $23 billion acquisition of wireless spectrum licenses from EchoStar. This move aims to expand its low- and mid-band coverage across over 400 U.S. markets, reinforcing its 5G and broadband services.

Verizon has been actively expanding its 5G network to support both consumer and enterprise needs. The company has been focusing on enhancing its 5G infrastructure to provide faster and more reliable services to its customers.

T-Mobile US has been a leader in 5G deployment, leveraging its nationwide spectrum holdings to offer extensive coverage. The company continues to expand its 5G network to provide high-speed connectivity across the United States.

Infrastructure Providers

Ericsson remains a key player in the U.S. 5G infrastructure market. The company has secured a $14 billion deal with AT&T to provide radio access network (RAN) equipment, solidifying its position as a leading supplier in North America.

Nokia has strengthened its presence in the U.S. market through a multi-year agreement with AT&T to enhance voice carriage and 5G network automation. This partnership underscores Nokia's commitment to advancing 5G technologies in the region.

JMA Wireless, an American company based in Syracuse, New York, specializes in Open-RAN compliant 5G RAN products and private wireless technology hardware. JMA Wireless has been recognized for creating the first fully virtualized RAN for carrier and private networks in the United States.

Emerging Disruptors

Mint Mobile, a subsidiary of T-Mobile, has launched its own 5G home internet service called MINTernet. Offering competitive pricing and leveraging T-Mobile's nationwide 5G network, Mint Mobile aims to disrupt the traditional broadband market.

Fonus Mobile, an American mobile virtual network operator, offers a $30 per month unlimited plan utilizing AT&T's 5G network. By focusing on affordability and simplicity, Fonus Mobile caters to cost-conscious consumers seeking reliable 5G connectivity.

Competitive Trends and Market Implications

The U.S. standalone 5G network market is witnessing several key trends:

- Consolidation: Strategic acquisitions, such as AT&T's purchase of spectrum licenses from EchoStar, are reshaping the competitive landscape, enabling companies to expand their service offerings and enhance network capabilities.

- Niche Specialization: Emerging players like Mint Mobile and Fonus Mobile are carving out niches by offering specialized services that cater to specific consumer needs, challenging traditional business models.

- Technological Innovation: Companies like JMA Wireless are driving innovation in network architecture, particularly with Open-RAN solutions, contributing to the evolution of 5G infrastructure.

For new entrants and existing businesses, these dynamics present opportunities to differentiate through specialized services, strategic partnerships, and technological advancements. Staying attuned to regulatory developments and consumer preferences will be crucial for sustained growth and competitiveness in the evolving 5G landscape.

Why Choose Kenneth Research ?

-

Insight with Impact : We don’t just gather data — we uncover stories, trends, and opportunities that fuel business growth.

-

Experts Who Get It : Our team speaks your industry’s language and knows what really matters to your customers and market.

-

Custom-Built for You : Forget one-size-fits-all. We craft research and consulting solutions as unique as your business vision.

-

Partners, Not Just Providers : We work with you, not for you — collaborating closely to turn insights into smart, strategic moves.

-

Results That Speak : Our work powers brands, startups, and industry leaders alike — with a track record of ideas that work in the real world.

Report ID: 1001 |

Published Date: 05 Nov 2025 |

Report Format: |

Delivery Timeline: 48-72 Business Hours

Thank you for contacting us!

We have received your sample request for the research report. Our research representative will contact you shortly.

Get Free Sample Report

United States Standalone 5G Network Market

Copyright © 2025 Kenneth Research. All rights reserved. Terms of Use | Privacy Policy