United States (U.S.) Broadcasting and Cable TV Market Size & Share, by Technology, Channel - Macroeconomic Analysis, Growth Trends, Top Companies, Forecast Report 2026-2035

Report ID: 1003 |

Published Date: 05 Nov 2025 |

Report Format: |

Delivery Timeline: 48-72 Business Hours

U.S. Broadcasting and Cable TV Market Outlook:

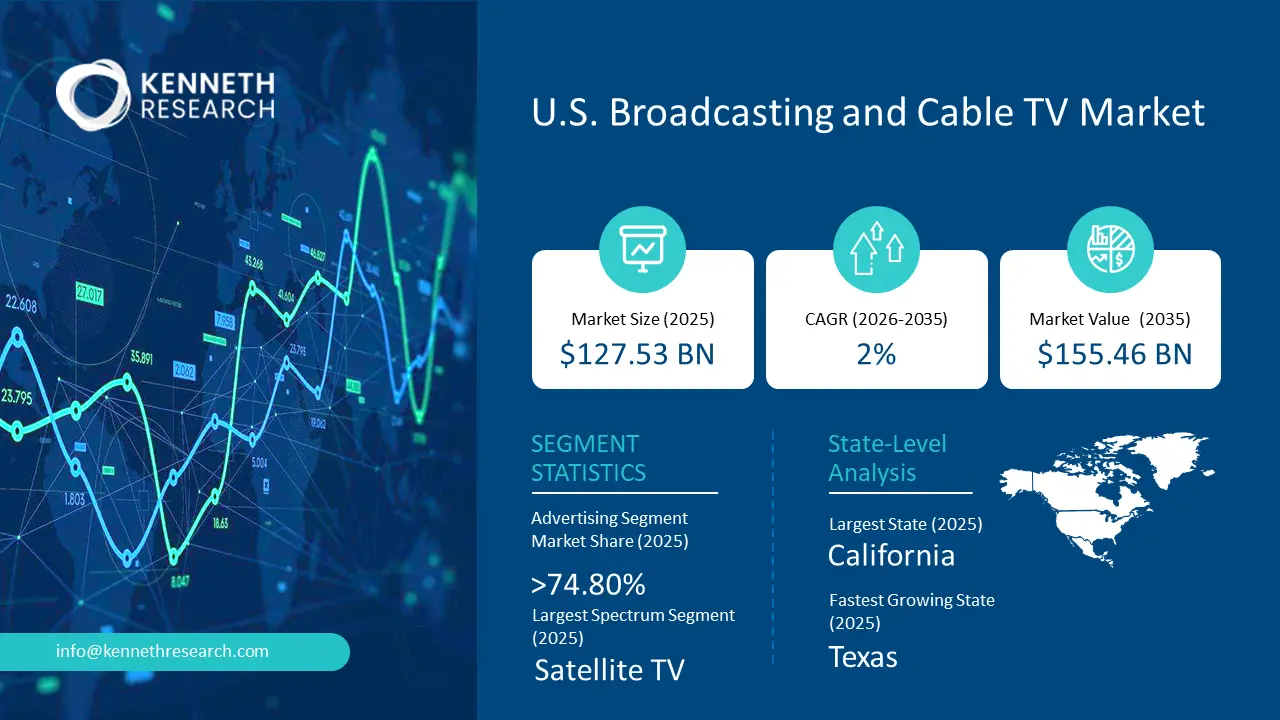

U.S. Broadcasting and Cable TV Market size was valued at over USD 127.53 billion in 2025 and is poised to surpass USD 155.46 billion by 2035, growing at 2% CAGR during 2026-2035. In 2026, the industry size is estimated at USD 129.91 billion.

U.S. Broadcasting and Cable TV Market: Growth Drivers & Challenges

Growth Drivers -

- Transition to Digital and Streaming Ecosystems: The U.S. broadcasting and cable TV market is being reshaped by the rapid transition from linear television to digital and streaming-based ecosystems. Consumers are increasingly opting for on-demand and ad-free experiences, leading to a decline in traditional cable subscriptions while fueling growth for digital content aggregators and hybrid broadcast models. Major players such as NBCUniversal and Disney are expanding their streaming platforms (Peacock and Disney+, respectively) to retain audiences migrating online, while cable providers like Comcast are investing in cloud-based set-top boxes that integrate OTT services directly. This convergence blurs the lines between broadcast and streaming, transforming how audiences consume and pay for content. To stay competitive, businesses should focus on hybrid content delivery—merging broadcast reliability with the personalization and analytics-driven advertising capabilities of streaming platforms.

- Content Personalization and Data-Driven Advertising: A major growth driver for the U.S. broadcasting and cable TV market is the shift toward data-enabled, targeted advertising. Traditional broadcast advertising models are being replaced by advanced audience analytics, allowing networks to serve tailored ads based on viewer preferences, location, and viewing habits. Companies like Warner Bros. Discovery and Paramount Global are leveraging AI-driven insights to deliver customized ad experiences across both linear and streaming channels. Meanwhile, addressable advertising technology enables advertisers to reach segmented audiences even within a single broadcast stream. This evolution enhances ad efficiency, boosts viewer engagement, and creates new revenue opportunities. To capitalize on this shift, broadcasters should invest in robust audience data infrastructure and form partnerships with ad-tech firms to enable programmatic buying, dynamic ad insertion, and cross-platform campaign measurement.

- Regulatory Shifts and Infrastructure Modernization: Evolving FCC policies, spectrum reallocation, and next-generation broadcast standards are reshaping the competitive landscape for the U.S. broadcasting and cable TV industry. The rollout of ATSC 3.0, or NextGen TV, enhances transmission quality, interactivity, and data capabilities, positioning broadcasters to compete with digital platforms on both quality and functionality. At the same time, net neutrality debates and local content mandates continue to influence distribution costs and market accessibility. Broadcasters like Sinclair Broadcast Group and Nexstar Media are leading pilot programs integrating ATSC 3.0 with enhanced local news and emergency alert services, demonstrating innovation within a regulated framework. Businesses in this space should proactively engage with regulators, invest in infrastructure upgrades, and explore partnerships with telecom and 5G providers to deliver interactive and mobile-friendly broadcast experiences that align with emerging compliance and consumer expectations.

Challenges –

- Digital Disruption and Streaming Dominance: The rapid shift from traditional cable TV to digital and over-the-top (OTT) streaming services has fundamentally disrupted the U.S. broadcasting and cable TV market. Viewers are increasingly favoring on-demand and ad-free experiences offered by platforms such as Netflix, Hulu, Disney+, and Amazon Prime Video. This trend has eroded cable subscriber bases and weakened linear TV advertising revenues. Established broadcasters like NBCUniversal and Paramount Global have responded by expanding their streaming footprints—launching Peacock and Paramount+ to retain audience engagement. Similarly, Comcast is investing in hybrid models that blend broadband services with digital content offerings to counter cord-cutting pressures.

Strategic Insight: To sustain relevance, traditional broadcasters must adopt flexible distribution strategies, leverage advanced data analytics for personalized content delivery, and embrace content syndication partnerships across digital ecosystems. Integrating advertising-supported streaming tiers and interactive features can also help reclaim lost ad revenue and broaden reach across younger demographics. - Rising Content Costs and Licensing Pressures: The escalating cost of content production and licensing poses a significant strain on broadcasters and cable networks. Premium programming—especially live sports rights, original series, and exclusive content—is becoming increasingly expensive, forcing networks to balance between audience retention and profitability. For instance, ESPN and Fox Sports continue to face steep sports-rights renewals, while networks like AMC and Discovery are merging content libraries to share production burdens. Additionally, the competitive streaming environment has driven up talent and creative costs, challenging traditional revenue models based on subscription and advertising splits.

Strategic Insight: Companies can mitigate these pressures by investing in owned intellectual property, co-production deals, and localized content strategies. Developing scalable content frameworks that repurpose assets across multiple platforms—linear, streaming, and social—can maximize ROI. Furthermore, leveraging AI-driven content optimization and virtual production technologies can reduce production costs while maintaining creative quality.

U.S. Broadcasting and Cable TV Market Size and Forecast:

| Report Attribute | Details |

|---|---|

| Base Year |

2025 |

| Forecast Year |

2026-2035 |

| CAGR |

2% |

| Base Year Market Size (2025) |

USD 127.53 billion |

| Forecast Year Market Size (2035) |

USD 155.46 billion |

U.S. Broadcasting and Cable TV Market Opportunities:

Transition to Hybrid Broadcast-Streaming Models

The convergence of linear television and digital streaming is reshaping the U.S. broadcasting and cable TV ecosystem. Traditional cable operators are integrating over-the-top (OTT) services into bundled offerings to retain subscribers who increasingly favor on-demand viewing. Comcast’s Xfinity Stream and Charter’s Spectrum TV App are prime examples of hybrid models enabling customers to access both live and streamed content seamlessly. Networks like NBC and CBS are leveraging cross-platform content syndication to maximize audience reach and ad monetization.

Insight: Broadcasters can capitalize on this shift by investing in unified content delivery platforms, strengthening digital rights management, and fostering collaborations with streaming players to diversify revenue and maintain viewership across age demographics.

Rise of Addressable and Programmatic Advertising

The U.S. market is witnessing a rapid adoption of data-driven advertising across cable and broadcast networks. Addressable advertising allows precise targeting of households or viewers, enhancing engagement and reducing ad waste. Media giants such as Warner Bros. Discovery and Disney have adopted programmatic advertising platforms to dynamically deliver tailored campaigns through their cable and digital networks. The integration of AI analytics and real-time audience measurement is transforming ad sales into performance-based systems.

Insight: To fully leverage this opportunity, companies should strengthen partnerships with ad-tech providers, standardize audience metrics across linear and digital channels, and develop privacy-compliant data frameworks that enable personalized yet ethical advertising.

Expansion of Content Syndication and Localization

As audience preferences fragment, broadcasters are turning to localized and syndicated content to strengthen regional viewership and advertiser relevance. Local stations and cable affiliates are increasingly producing region-specific programs, community news, and culturally resonant entertainment. Companies such as Sinclair Broadcast Group and Nexstar Media are expanding local content production and integrating social media engagement to increase loyalty and attract local advertisers. Syndicated content — from talk shows to sports highlights — continues to provide scalable revenue opportunities for networks seeking steady ratings.

U.S. Broadcasting and Cable TV Market Segmentation:

Advertising accounts for 74.80% of the revenue share in the U.S. broadcasting and cable TV market, underscoring its critical role as the economic backbone of the industry. This dominance is driven by the ability of broadcasters and cable networks to reach mass audiences and deliver measurable brand impact across demographics and regions. The segment benefits from sustained investments by major brands in television ad slots, especially during live sports, primetime shows, and national events that still command significant viewership despite digital media competition. Companies like NBCUniversal, Warner Bros. Discovery, and Paramount Global continue to leverage cross-platform advertising strategies that combine traditional TV exposure with connected TV (CTV) and programmatic advertising models, enhancing campaign precision and return on investment. Regulatory stability, audience measurement advancements by Nielsen, and the integration of data-driven ad technologies further support the segment’s leadership by aligning broadcasters’ offerings with evolving advertiser demands for reach, relevance, and measurable outcomes.

Satellite TV represents the largest segment within the U.S. broadcasting and cable TV market, commanding 42.70% of the share due to its extensive geographic reach and consistent service reliability in areas where cable infrastructure remains limited. Its dominance is reinforced by the demand for nationwide coverage and premium content bundles that cater to both urban and rural audiences. Major providers such as DirecTV and Dish Network have sustained this leadership through diversified channel offerings, high-definition broadcasting, and flexible subscription models that appeal to households seeking robust entertainment access without dependence on fiber or cable networks. Furthermore, satellite technology’s integration with internet-based streaming and on-demand platforms has helped it remain relevant amid the industry’s digital convergence. The segment’s resilience also stems from strategic partnerships with sports leagues, news networks, and content producers, which continue to strengthen its role in delivering live events and exclusive programming across the U.S.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegment |

|

Technology |

|

|

Channel |

|

State-Level Analysis for U.S. Broadcasting and Cable TV Market:

California stands as the largest state in the U.S. broadcasting and cable TV market. California is the undisputed hub of the media and entertainment industry, anchored by the Los Angeles market where studios like The Walt Disney Company and major broadcasters operate. The state’s deep infrastructure—sound-stages, production crews, broadcast networks, and cable operations—creates a highly concentrated industry base. For example, California leads the nation in employment in internet publishing, broadcasting and related media with over 171,000 employees, far ahead of other states. The presence of major network headquarters, large-scale content production and the ecosystem of ancillary services (post-production, talent agencies, technical services) bolster its dominance. In short, California’s scale in terms of content production, broadcast operations, and media infrastructure underpin its position as the largest state in the broadcasting & cable TV market.

Texas is emerging as the fastest-growing state in the U.S. broadcasting and cable TV market. While California remains dominant, Texas has shown meaningful momentum in media market expansion, particularly driven by the growth of the Dallas–Fort Worth region (which recently overtook Philadelphia in the DMA rankings) and the state’s ability to attract production, broadcast facilities and digital content services. Texas offers lower cost structures, attractive business climates and is increasingly a choice location for regional broadcast hubs and cable-operator back-ends. The shifting landscape of broadcasting—where traditional linear models are adapting and new IP/streaming infrastructure is being deployed—gives states like Texas, with strong telecom infrastructure and media service investments, a growth edge. Thus Texas merits recognition as the fastest-growing state for broadcasting and cable activities, as its ecosystem expands beyond legacy markets and it gains share in production, retransmission and network operations.

U.S. Broadcasting and Cable TV Market: Competitive Landscape

The U.S. broadcasting and cable TV market is undergoing a profound transformation driven by digital convergence, streaming adoption, and evolving audience behaviors. While traditional cable networks continue to play a pivotal role in content distribution, the landscape is increasingly shaped by hybrid strategies blending broadcasting strength with on-demand digital innovation. Key players are focusing on integrating advanced analytics, AI-driven content personalization, and multi-platform advertising to sustain engagement in a fragmenting viewership environment.

Leading Companies and Their Strategies

- Comcast Corporation: Comcast continues to dominate the U.S. cable ecosystem through its Xfinity and NBCUniversal brands. The company’s strategy emphasizes convergence between broadband, television, and streaming via platforms such as Peacock. Comcast’s investments in AI-based ad targeting, sports broadcasting rights, and original programming illustrate its commitment to retaining cross-platform viewership and advertiser loyalty.

- The Walt Disney Company: Disney’s dual approach—leveraging legacy broadcasting assets like ABC alongside its streaming services (Disney+, Hulu, ESPN+)—positions it as a major cross-channel leader. The firm is restructuring its entertainment division to unify creative production and distribution, reflecting a strategy centered on scalable digital monetization while maintaining high-value linear content.

- Paramount Global: Formerly ViacomCBS, Paramount Global is strengthening its integrated ecosystem through Paramount+ and Pluto TV. Its approach blends free ad-supported streaming (FAST) with premium subscription models, supported by a strong portfolio of film studios and TV networks. The company’s focus on global content partnerships and franchise expansion reinforces its adaptability in a hybrid broadcast-streaming model.

- Warner Bros. Discovery: Following its merger, Warner Bros. Discovery has strategically consolidated its broadcasting and cable assets with streaming platforms such as Max (formerly HBO Max). The company is optimizing its content library, focusing on sports, news, and entertainment synergies, while pursuing sustainability through operational streamlining and digital ad innovation.

- Fox Corporation: Fox remains a prominent player in live broadcasting, emphasizing sports, news, and event-based entertainment. Its Fox Nation streaming service and strategic investments in ad-tech platforms highlight a pivot toward digital monetization without undermining its cable dominance. Fox’s emphasis on brand identity and political programming differentiation sustains its strong viewer base.

- Charter Communications (Spectrum): Charter’s Spectrum brand continues to focus on bundled video, internet, and mobile services. The company’s strategy revolves around user retention through simplified packages and digital enhancements. Its growing emphasis on addressable advertising and partnerships with streaming players positions it as an agile competitor adapting to shifting media consumption.

- Netflix Inc. (Emerging Disruptor): Although traditionally outside the cable ecosystem, Netflix’s growing integration with legacy TV distributors via bundled packages and partnerships marks a structural change in the market. Its influence drives traditional broadcasters to adopt on-demand formats and data-driven content development strategies.

Market Dynamics and Competitive Trends

The U.S. broadcasting and cable TV market is witnessing intensified consolidation and digital integration. Legacy broadcasters are investing in direct-to-consumer (D2C) platforms and content personalization technologies to compete with streaming-native entrants. Simultaneously, FAST channels and AVOD models are redefining advertising monetization, enabling broadcasters to reach cord-cutters through data-driven targeting.

Technological convergence—particularly cloud-based playout systems, 4K/8K broadcasting, and edge computing—is optimizing content delivery efficiency. Moreover, strategic alliances between broadcasters and telecom operators are enhancing multi-device accessibility. The market also shows a rising focus on sustainability, with major networks reducing carbon footprints in production and transmission operations.

Implications for Industry Participants

For new entrants and existing broadcasters, the U.S. market offers opportunities in hybrid content delivery, data-centric advertising, and localized programming. Strategic differentiation will depend on the ability to balance traditional linear strength with digital agility. Collaboration with streaming platforms, telecom providers, and technology firms can unlock new monetization paths while addressing consumer demand for flexibility and personalization. Ultimately, those aligning innovation with content diversity and ethical broadcasting will define the next competitive chapter of the U.S. broadcasting and cable TV market.

Why Choose Kenneth Research ?

-

Insight with Impact : We don’t just gather data — we uncover stories, trends, and opportunities that fuel business growth.

-

Experts Who Get It : Our team speaks your industry’s language and knows what really matters to your customers and market.

-

Custom-Built for You : Forget one-size-fits-all. We craft research and consulting solutions as unique as your business vision.

-

Partners, Not Just Providers : We work with you, not for you — collaborating closely to turn insights into smart, strategic moves.

-

Results That Speak : Our work powers brands, startups, and industry leaders alike — with a track record of ideas that work in the real world.

Report ID: 1003 |

Published Date: 05 Nov 2025 |

Report Format: |

Delivery Timeline: 48-72 Business Hours

Thank you for contacting us!

We have received your sample request for the research report. Our research representative will contact you shortly.

Get Free Sample Report

United States Broadcasting and Cable TV Market

Copyright © 2025 Kenneth Research. All rights reserved. Terms of Use | Privacy Policy