United States (U.S.) Application Delivery Controller Market Size & Share, by Deployment, Enterprise Size, End Use - Macroeconomic Analysis, Growth Trends, Top Companies, Forecast Report 2026-2035

Report ID: 1002 |

Published Date: 05 Nov 2025 |

Report Format: |

Delivery Timeline: 48-72 Business Hours

U.S. Application Delivery Controller Market Outlook:

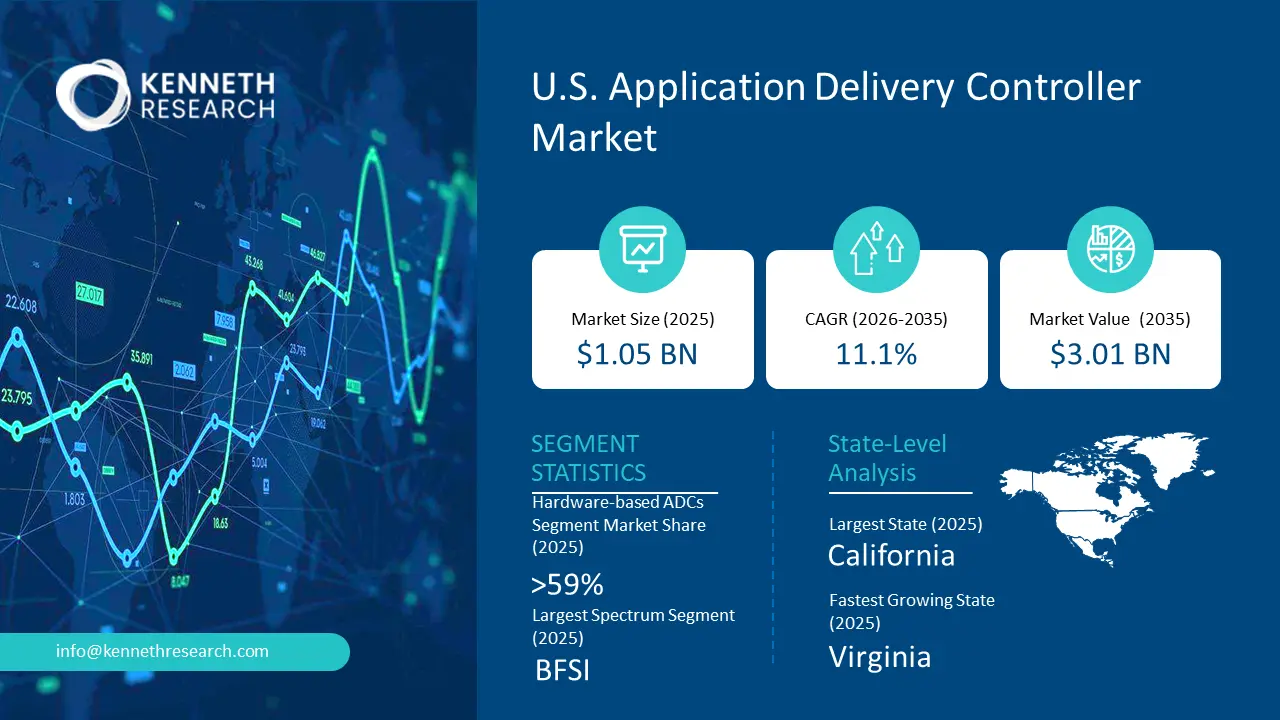

U.S. Application Delivery Controller Market size was valued at over USD 1.05 billion in 2025 and is projected to cross USD 3.01 billion by 2035, expanding at 11.1% CAGR during 2026-2035. In 2026, the industry size is estimated at USD 1.16 billion.

U.S. Application Delivery Controller Market: Growth Drivers & Challenges

Growth Drivers –

- Rising Demand for Secure and Agile Application Delivery: As organizations accelerate their digital transformation journeys, the demand for secure, agile, and high-performance application delivery is becoming a central growth driver in the U.S. Application Delivery Controller (ADC) market. Businesses are increasingly reliant on web-based and cloud-native applications, requiring ADCs that ensure consistent availability, load balancing, and protection against cyber threats. Major players like F5 Networks and Citrix are integrating advanced SSL offloading, zero-trust architecture, and DDoS protection into their ADC portfolios to meet evolving enterprise security needs. Similarly, A10 Networks has emphasized AI-powered threat analytics to enhance security posture while maintaining traffic efficiency. To capitalize on this driver, companies should focus on offering ADCs with built-in security intelligence, real-time traffic monitoring, and policy automation to align with the zero-trust and hybrid IT strategies of modern enterprises.

- Expansion of Cloud and Multi-Cloud Environments: The proliferation of hybrid and multi-cloud infrastructures is redefining how applications are delivered and managed across distributed environments. ADCs are evolving from traditional hardware-based appliances to software-defined and cloud-native solutions that provide consistent application performance regardless of deployment location. Vendors such as Kemp Technologies and Fortinet are offering ADCs optimized for AWS, Azure, and Google Cloud platforms to ensure interoperability and centralized management. F5’s distributed cloud services further exemplify this trend, enabling unified control and visibility across multiple cloud instances. This transition creates opportunities for ADC providers to deliver subscription-based and as-a-service models, catering to enterprises seeking flexibility and scalability. To stay competitive, businesses should develop cloud-agnostic ADC solutions with unified policy frameworks, API integration, and analytics-driven orchestration.

- Surge in Application Modernization and API-Centric Architectures: The rapid shift toward microservices and containerized applications is fueling demand for ADCs that can support dynamic, API-driven workloads. As enterprises adopt Kubernetes and DevOps methodologies, ADCs are being reengineered to function as lightweight, programmable components capable of managing service-to-service traffic and automating load distribution. Companies like NGINX (an F5 company) and HAProxy Technologies are leading this transformation by embedding ADC functionalities directly into application pipelines to enhance developer agility and deployment speed. These innovations are enabling enterprises to deliver faster, more resilient applications while maintaining control over traffic policies and user experience. To leverage this trend, ADC vendors should emphasize integration with CI/CD pipelines, API gateways, and observability tools to align with the growing ecosystem of modern application delivery.

Challenges –

- Rising Complexity in Multi-Cloud Environments: As enterprises continue migrating workloads across hybrid and multi-cloud infrastructures, managing consistent application performance and security has become increasingly complex. The fragmentation of cloud environments often leads to challenges in ensuring seamless traffic routing, unified policy enforcement, and real-time visibility. Traditional ADC architectures struggle to deliver the same level of control and latency optimization across diverse deployment models. Companies such as F5 Networks and Citrix Systems are addressing this by evolving toward software-defined ADCs and cloud-native load balancing platforms, offering centralized orchestration across multiple environments. To navigate this challenge, U.S. businesses should invest in cloud-agnostic ADC solutions that integrate AI-driven analytics for traffic management, automate policy deployment, and enhance operational resilience across hybrid systems.

- Heightened Cybersecurity and Compliance Demands: The surge in encrypted web traffic, coupled with tightening data privacy regulations, has amplified the security burden on ADCs. Modern ADCs are expected to not only optimize performance but also defend against DDoS attacks, API vulnerabilities, and session hijacking. However, integrating deep security features can strain performance and inflate deployment costs. Vendors like A10 Networks and Radware are mitigating these issues through embedded SSL/TLS offloading, zero-trust frameworks, and behavioral analytics that secure traffic without compromising throughput. To stay competitive, enterprises should adopt security-centric ADC architectures that integrate with next-generation firewalls and identity systems—turning compliance and protection requirements into opportunities for building customer trust and operational efficiency.

U.S. Application Delivery Controller Market Size and Forecast:

| Report Attribute | Details |

|---|---|

| Base Year |

2025 |

| Forecast Year |

2026-2035 |

| CAGR |

11.1% |

| Base Year Market Size (2025) |

USD 1.05 billion |

| Forecast Year Market Size (2035) |

USD 3.01 billion |

U.S. Application Delivery Controller Market Opportunities:

Cloud-Native and Hybrid ADC Deployment

The growing shift toward multi-cloud and hybrid environments is transforming how enterprises manage traffic and application delivery. Traditional hardware-based ADCs are being replaced by cloud-native, software-defined solutions that integrate seamlessly with Kubernetes and containerized workloads. Companies such as F5 Networks and Citrix Systems are advancing cloud ADC offerings with built-in analytics, automation, and scalability features to support modern DevOps environments. This transition enables businesses to ensure consistent application performance and security across diverse infrastructures.

AI-Driven Traffic Management and Security

As application complexity and cyber threats intensify, AI and machine learning are being integrated into ADCs to optimize routing, detect anomalies, and predict potential disruptions. Leading players like A10 Networks and Radware are embedding AI algorithms to dynamically balance loads and protect against DDoS attacks and zero-day vulnerabilities. This evolution turns ADCs from mere traffic controllers into intelligent application gateways capable of self-learning and adaptive defense.

Edge Computing and 5G Integration

The expansion of 5G and edge computing ecosystems is opening new frontiers for ADC vendors. With enterprises distributing applications closer to users and devices, ADCs are being re-engineered for ultra-low-latency traffic management and content optimization at the edge. Fortinet and Array Networks, for instance, are leveraging edge ADC architectures to support IoT-heavy and latency-sensitive applications in industries like telecom, healthcare, and autonomous systems.

U.S. Application Delivery Controller Market Segmentation:

Hardware-based ADCs accounted for 59% of the U.S. application delivery controller market in 2025, underscoring their dominance driven by reliability, low latency, and superior throughput capabilities. These devices remain the backbone of large-scale enterprise data centers that demand predictable performance for traffic management, SSL offloading, and secure content delivery. Despite the growing shift toward cloud-native architectures, many organizations continue to invest in physical ADC appliances to maintain control over mission-critical workloads. The hybrid IT landscape—where enterprises balance on-premise and cloud resources—further strengthens this segment’s position. Industry leaders such as F5 Networks, Citrix Systems, and A10 Networks continue to expand hardware ADC offerings with embedded security analytics and AI-based optimization, ensuring relevance amid evolving network demands.

The BFSI segment holds the largest share of the U.S. Application Delivery Controller (ADC) market, primarily due to its heightened need for secure, high-performance digital infrastructure that supports online banking, financial transactions, and real-time data processing. Financial institutions are under constant pressure to ensure uninterrupted service delivery and robust cybersecurity, both of which are enabled by advanced ADC solutions. The sector’s accelerated digital transformation—spanning mobile banking, fintech integration, and API-driven ecosystems—has made ADCs essential for managing complex application traffic and ensuring low-latency performance. Moreover, regulatory frameworks demanding data privacy and uptime reliability further drive adoption in BFSI environments. Leading companies such as F5 Networks, Citrix Systems, and A10 Networks are actively deploying intelligent ADC architectures to enhance load balancing, encryption, and threat mitigation for major banks and insurance providers, reinforcing BFSI’s dominant position in the market.

Large enterprises held the largest share of the U.S. application delivery controller market in 2025, reflecting their complex network infrastructures and demand for high scalability. These organizations depend on ADCs to deliver seamless application availability and performance across multi-cloud and hybrid environments. As digital transformation accelerates, large enterprises prioritize load balancing, traffic encryption, and zero-downtime operations to support mission-critical applications. Their adoption of ADCs is further driven by compliance requirements and the need to deliver consistent user experiences globally. Companies such as Amazon, Microsoft, and IBM exemplify this trend, deploying advanced ADC systems to manage data-intensive applications and ensure business continuity across distributed data centers.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegment |

|

Deployment |

|

|

Enterprise Size |

|

|

End Use |

|

State-Level Analysis for U.S. Application Delivery Controller Market:

California stands as the largest state in the U.S. application delivery controller market, primarily thanks to its deep concentration of technology enterprises, data centres, cloud service providers and digital-native users. California houses Silicon Valley and many of the leading infrastructure and software companies that drive demand for advanced application delivery, load-balancing and performance solutions. Vendors in this space benefit from the state’s high-density enterprise base, early adoption of cloud-native and hybrid-multi-cloud environments, and substantial investment in network, data-centre and application-security infrastructure. The state’s lead in technology innovation creates a strong anchor point for ADC market activity. While national reports tend to speak at the country rather than state level, proxy metrics—such as California ranking third in one data-centre count list (behind Virginia and Texas) yet leading in employment for data-hosting services—indicate its outsized role. The presence of hyperscale, high-performance computing and enterprise SaaS deployments all reinforce California’s leadership position in the ADC ecosystem.

Virginia is emerging as the fastest-growing state in the U.S. application delivery controller market, propelled by an extraordinary concentration of data-centre build-out, hyperscale infrastructure investment and adjacent application delivery demand. The region around Northern Virginia—often dubbed “Data Center Alley”—hosts large international cloud, hosting and infrastructure providers, making it a global hub for connectivity and application-traffic management. Reports show Virginia leading the nation in data-centre project count and capacity growth—thanks to its fiber-rich connectivity, strong tax incentives and proximity to federal IT/hosting markets. In that context, as enterprises and cloud providers scale workloads, the demand for ADC solutions (to optimise application delivery, security and performance across expansive infrastructure) is likely to accelerate more rapidly in Virginia than in more mature states. Thus Virginia’s ecosystem of data-centre growth and host-networking strength positions it as the fastest-growing sub-national ADC market in the U.S.

U.S. Application Delivery Controller Market: Competitive Landscape

The U.S. application delivery controller (ADC) market is evolving rapidly as enterprises modernize their network architectures to support cloud-native applications, zero-trust frameworks, and high-performance digital experiences. ADCs, which optimize and secure application traffic across hybrid and multi-cloud environments, have become essential for enterprises navigating digital transformation and cybersecurity challenges. The competitive landscape is shaped by both established network infrastructure leaders and innovative startups leveraging software-defined and AI-driven solutions.

Leading Companies and Strategic Initiatives

F5, Inc. remains a dominant force in the U.S. ADC market, driving innovation through its transition from hardware-centric to software and cloud-native solutions. The company’s BIG-IP and NGINX platforms enable flexible application delivery across public and private clouds. F5’s acquisition of NGINX and subsequent investments in F5 Distributed Cloud Services reflect its strategy to provide integrated security, load balancing, and edge computing capabilities tailored to modern workloads.

Citrix Systems (now part of Cloud Software Group) continues to strengthen its ADC offerings with a focus on application performance optimization and hybrid deployment models. Citrix ADC solutions are widely used in enterprise environments requiring high reliability and secure remote access. The company emphasizes integration with virtualization and digital workspace platforms, positioning its ADCs as core enablers of secure digital employee experiences.

A10 Networks has carved a strong position through its Thunder ADC series, known for scalability and security. The company is actively integrating machine learning-driven analytics for traffic visibility and automated threat mitigation. Strategic partnerships with cloud providers and telecom operators underscore A10’s push toward carrier-grade and 5G-ready ADC solutions, reinforcing its role in next-generation networking.

Radware Ltd. differentiates itself through advanced DDoS protection and Web Application Firewall (WAF) capabilities embedded within its ADC suite. The company’s focus on behavioral-based threat detection and hybrid cloud protection appeals to organizations prioritizing cybersecurity resilience. Radware’s collaboration with hyperscalers such as AWS and Azure enhances its market relevance in multi-cloud deployments.

Kemp Technologies (acquired by Progress Software) has gained momentum with its LoadMaster ADC platform, offering simplified deployment, cost efficiency, and deep observability tools for mid-market enterprises. Kemp’s integration with DevOps and CI/CD pipelines supports agile application delivery — an area increasingly important for digital-first organizations.

Barracuda Networks continues to expand its presence with cloud-native ADC and application security solutions targeted at small and midsized enterprises. Its cloud-integrated ADC offerings emphasize ease of management, API security, and cost-effectiveness, aligning with the growing demand for simplified application delivery in SaaS ecosystems.

Emerging innovators like Avi Networks (now part of VMware) and NGINX (under F5) further drive competition by enabling software-defined load balancing and microservices-oriented architectures. VMware’s integration of Avi’s capabilities into its NSX networking suite illustrates the trend toward full-stack automation and unified application visibility across hybrid environments.

Market Structure and Competitive Dynamics

The U.S. ADC market is transitioning from traditional hardware-based models to software-defined, cloud-native, and service-centric architectures. This shift favors vendors with strong software expertise, ecosystem partnerships, and platform integration capabilities. Leading players are focusing on automation, observability, and security convergence, redefining how ADCs fit within broader digital infrastructure strategies.

Open-source innovation, led by NGINX and HAProxy, also contributes to market democratization, offering developers flexible and cost-effective alternatives for cloud workloads. Meanwhile, telecom and enterprise IT modernization — particularly the adoption of 5G, SD-WAN, and containerized workloads — continue to open new growth opportunities for ADC vendors aligning with edge and API-driven delivery models.

Why Choose Kenneth Research ?

-

Insight with Impact : We don’t just gather data — we uncover stories, trends, and opportunities that fuel business growth.

-

Experts Who Get It : Our team speaks your industry’s language and knows what really matters to your customers and market.

-

Custom-Built for You : Forget one-size-fits-all. We craft research and consulting solutions as unique as your business vision.

-

Partners, Not Just Providers : We work with you, not for you — collaborating closely to turn insights into smart, strategic moves.

-

Results That Speak : Our work powers brands, startups, and industry leaders alike — with a track record of ideas that work in the real world.

Report ID: 1002 |

Published Date: 05 Nov 2025 |

Report Format: |

Delivery Timeline: 48-72 Business Hours

Thank you for contacting us!

We have received your sample request for the research report. Our research representative will contact you shortly.

Get Free Sample Report

United States Application Delivery Controller Market

Copyright © 2025 Kenneth Research. All rights reserved. Terms of Use | Privacy Policy