Kitchen Appliances Industry By Application (Residential, Commercial ), By Product (Refrigerators, Dishwashers, Ovens, Cookware and cooktops, Scales and thermometers), and By Application (Upstream Process, Downstream Process) – Global Market Opportunity and Current Growth Analysis 2019-2025

-

Product Code:

RP-ID-10079113 -

Published Date:

21 Oct 2022 -

Region:

Global

-

Pages:

110 -

Category:

FMCG & Food -

Publisher:

Pub-ID-27

Impact Analysis on the Growth of Market

Inflation and Looming Recession to Haunt Businesses:

In 2022 & 2023, market players expected to sail in rough waters; might incur losses due to huge gap in currency translation followed by contracting revenues, shrinking profit margins & cost pressure on logistics and supply chain. Further, U.S. economy is expected to grow merely by 3% in 2022.

....

The Research Report is Updated with 2022 Base Year, 2023 Estimated year and Forecast till 2035 with Market Insights.

With the dip in global production, the GDP has contracted in 2020 and impacted the market across the world. Upon placing a Sample Request, you will receive an updated report with 2022 as base year, 2023 as estimated year and forecast to 2035. This will have market drivers, recovery rate in the market, insights and competitive analysis.

Market Overview:

Translate Report

Global Kitchen Appliances Industry was valued at USD 223.6 Billion in the year 2018. Global Kitchen Appliances Industry is further estimated to grow at a CAGR of 6.5% from 2019 to reach USD 350 Billion by the year 2025. The North America region holds the highest Industry share in 2019 and the Asia Pacific is considered as the fastest growing Industry in the forecasted period. At a country level, US, China, and the U.S. are projected to grow strongly in the coming years due to increasing density of population and funding through Research and Development.

The Global Kitchen Appliances Industry is segmented as By Product, Application, and Region. The Product segment is divided into Refrigerators, Refrigerators, Dishwashers, Ovens, Cookware and cooktops, scales and thermometers and other products (Kettles and coffee makers) in which the refrigerators segment accounts for the highest Industry share due to growing efforts to develop advanced refrigerator models from global players. The Application segment is divided into commercial and residential in which the residential segment accounts for the largest Industry share due to rising expenditure on household appliances.

Major market players in Kitchen Appliances Industry are Philips N.V, Inalsa, Black and Decker, Morphy Richards, Faber, Siemens, Bosch, Bajaj, Maharaja, Miele, and Other 9 more companies detailed information is provided in the report.

SWOT analysis of Kitchen Appliances Industry

Strength:

Rapid change in lifestyle

Weakness:

Quite expensive

Opportunities:

Introduction of innovative products

Growth in investment through R&D

Threats:

Growing competition among key players

Kitchen Appliances Industry Segmentation:

Kitchen Appliances Industry Overview, By Product

• Refrigerators

• Dishwashers

• Ovens

• Cookware and cooktops

• Scales and thermometers

• Other products (Kettles and coffee makers)

Kitchen Appliances Industry Overview, By Application

• Residential

• Commercial

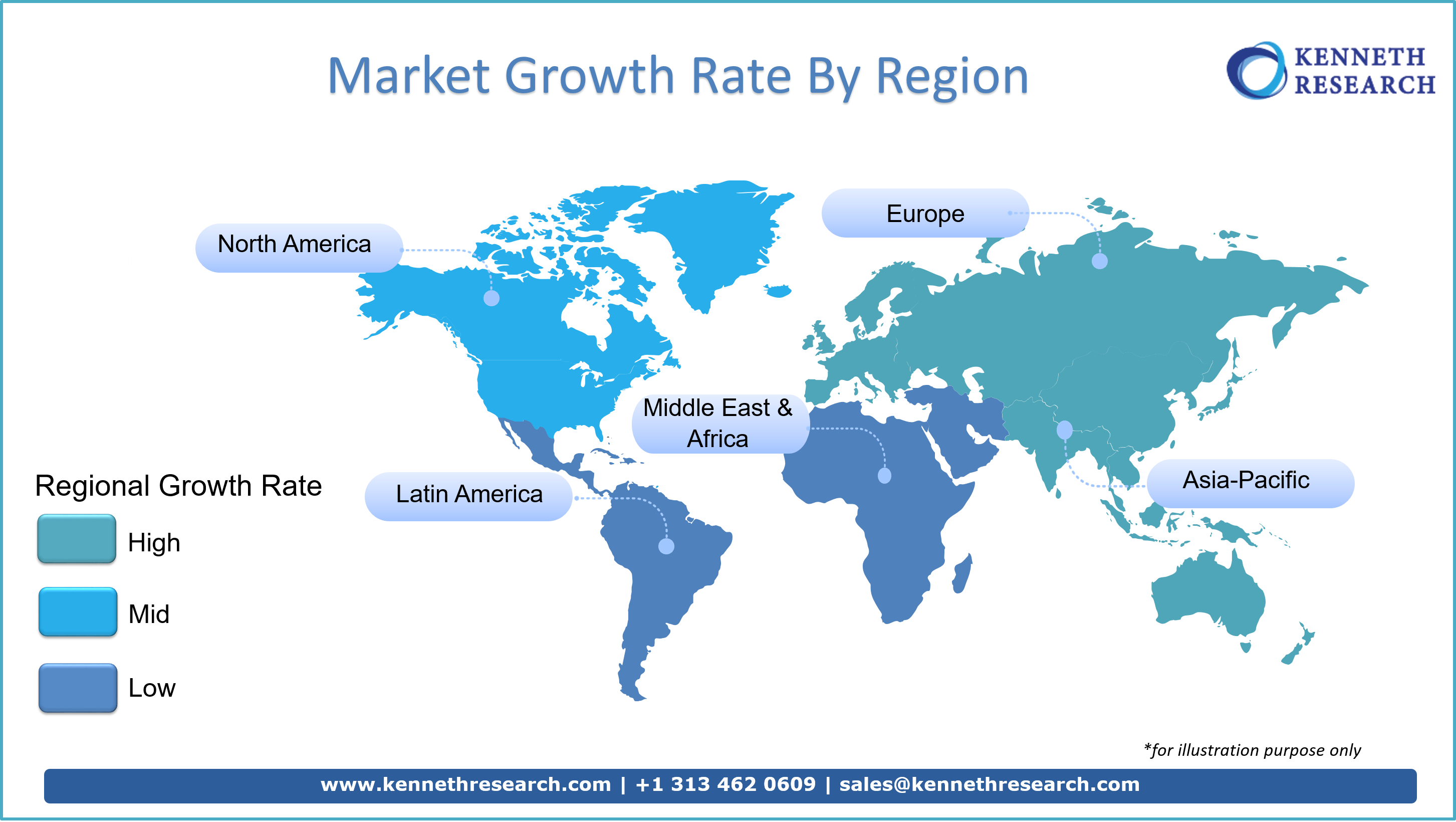

Kitchen Appliances Industry Overview, By Region

North America

• USA

• Canada

Europe

• Germany

• U.K.

• France

• Italy

• Rest of Europe

APAC

• China

• India

• Japan

• Rest of Asia-Pacific

RoW

• Latin America

• Middle East & Africa

Geography Analysis:

The report further discusses the market opportunity, compound annual growth rate (CAGR) growth rate, competition, new technology innovations, market players analysis, government guidelines, export and import (EXIM) analysis, historical revenues, future forecasts etc. in the following regions and/or countries:

- North America (U.S. & Canada) Market Size, Y-O-Y Growth, Market Players Analysis & Opportunity Outlook

- Latin America (Brazil, Mexico, Argentina, Rest of Latin America) Market Size, Y-O-Y Growth & Market Players Analysis & Opportunity Outlook

- Europe (U.K., Germany, France, Italy, Spain, Hungary, Belgium, Netherlands & Luxembourg, NORDIC(Finland, Sweden, Norway, Denmark), Ireland, Switzerland, Austria, Poland, Turkey, Russia, Rest of Europe), Poland, Turkey, Russia, Rest of Europe) Market Size, Y-O-Y Growth Market Players Analys & Opportunity Outlook

- Asia-Pacific (China, India, Japan, South Korea, Singapore, Indonesia, Malaysia, Australia, New Zealand, Rest of Asia-Pacific) Market Size, Y-O-Y Growth & Market Players Analysis & Opportunity Outlook

- Middle East and Africa (Israel, GCC (Saudi Arabia, UAE, Bahrain, Kuwait, Qatar, Oman), North Africa, South Africa, Rest of Middle East and Africa) Market Size, Y-O-Y Growth Market Players Analysis & Opportunity Outlook

.