Impact Analysis of COVID-19 on Europe Lighting as a Service Market Outlook 2028

-

Product Code:

RP-ID-10336406 -

Published Date:

21 Oct 2022 -

Region:

Global

-

Pages:

322 -

Category:

Semiconductor & Electronics -

Publisher:

Pub-ID-9

Impact Analysis on the Growth of Market

Inflation and Looming Recession to Haunt Businesses:

In 2022 & 2023, market players expected to sail in rough waters; might incur losses due to huge gap in currency translation followed by contracting revenues, shrinking profit margins & cost pressure on logistics and supply chain. Further, U.S. economy is expected to grow merely by 3% in 2022.

....

The Research Report is Updated with 2022 Base Year, 2023 Estimated year and Forecast till 2035 with Market Insights.

With the dip in global production, the GDP has contracted in 2020 and impacted the market across the world. Upon placing a Sample Request, you will receive an updated report with 2022 as base year, 2023 as estimated year and forecast to 2035. This will have market drivers, recovery rate in the market, insights and competitive analysis.

Market Overview:

Translate Report

Europe Lighting-as-a-Service (LaaS) Market Analysis 2019-2028

Lighting-as-a-Service (LaaS) is referred to the business model where end-users avail lighting services from LaaS providers on a subscription basis. LaaS includes services such as design, installations, maintenance, and restoration of lighting products and solutions in a facility. The Europe LaaS market is anticipated to achieve a CAGR of 26.5% during the forecast period, i.e. 2020-2028. Factors such as the increasing number of small and large projects across several end user verticals in Europe, rising construction activity in the region, increasing construction of smart cities and the growing use of LED and HID in the lighting industry are anticipated to promote towards the growth of the Europe LaaS market. Additionally, factors such as the increasing need for cost and energy efficient lighting from end users, backed by the flexible subscription model of LaaS and the increasing advancements of lighting technology that requires organizations to upgrade these at a lower costs are anticipated to drive the growth of the Europe LaaS market in the coming years.

The Europe LaaS market consists of various segments that are segmented by installation, components, technology, and by end user. The installation segment is further divided into indoor and outdoor installation. Indoor applications include office rooms, conference rooms, indoor parking areas, supermarkets, galleries, museums, schools, smart homes, residential houses, and others. Increasing urbanization & industrialization, along with the rising requirements for an efficient lighting solution in various indoor applications are some of the factors anticipated to drive the growth of the indoor installation segment during the forecast period. On the other hand, increasing local and federal requirements for quality lighting services for several outdoor applications, including outdoor parking, airport premises, transporting hubs, industrial outdoor premises, outdoor streets and roads, corporate campus, automotive lighting, educational campus, and others in the European countries are some of the factors anticipated to drive the growth of the outdoor installation segment in the coming years.

Some of the affluent industry leaders in the Europe LaaS market are Koninklijke Philips N.V., Illuxtron International, GE Lighting, OMS spol. s r.o., Halla, a.s., ADUROLIGHT, Osram Licht AG, OPPLE Lighting Co., Ltd. and Cree Lighting.

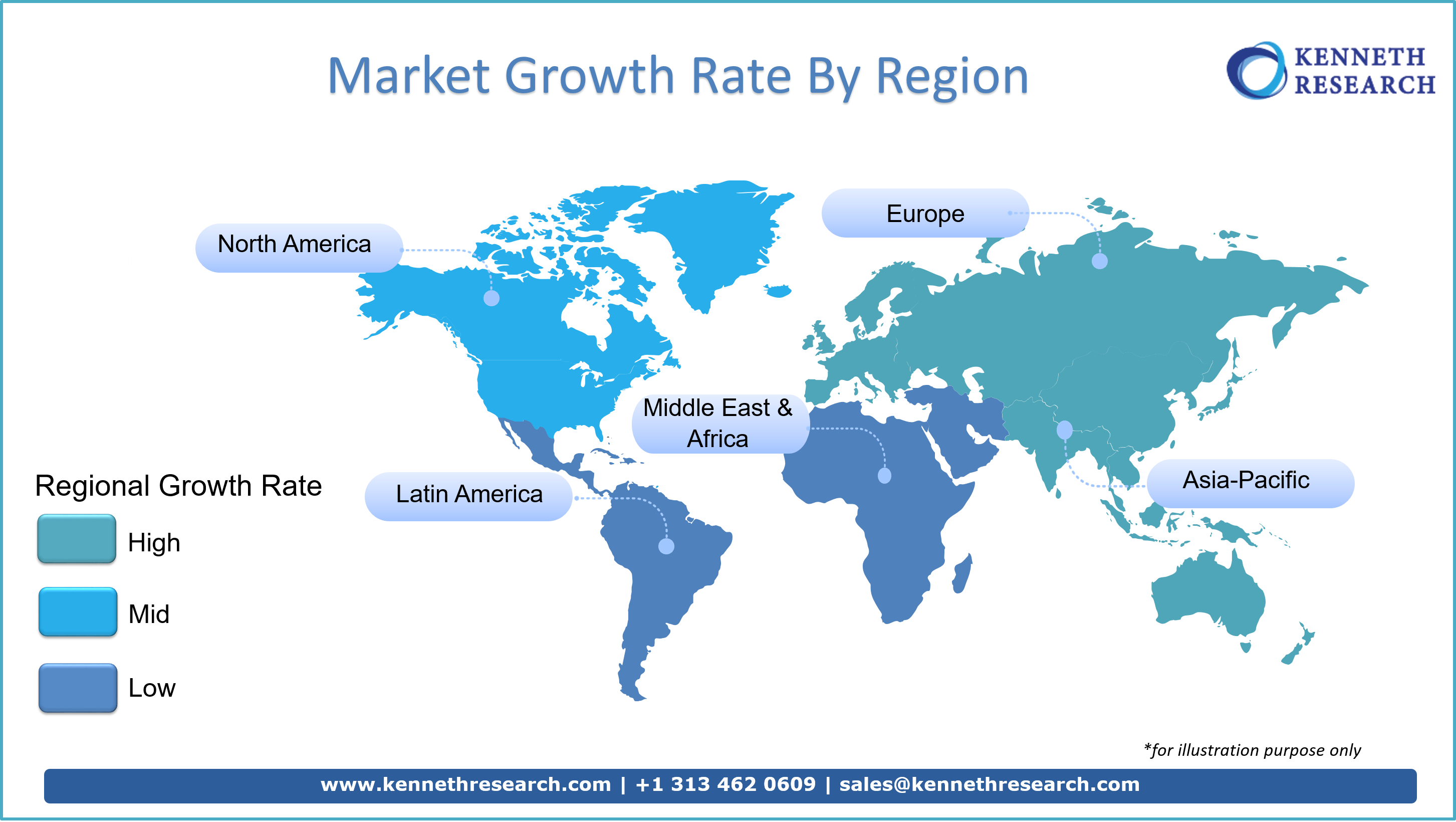

Geography Analysis:

The report further discusses the market opportunity, compound annual growth rate (CAGR) growth rate, competition, new technology innovations, market players analysis, government guidelines, export and import (EXIM) analysis, historical revenues, future forecasts etc. in the following regions and/or countries:

- North America (U.S. & Canada) Market Size, Y-O-Y Growth, Market Players Analysis & Opportunity Outlook

- Latin America (Brazil, Mexico, Argentina, Rest of Latin America) Market Size, Y-O-Y Growth & Market Players Analysis & Opportunity Outlook

- Europe (U.K., Germany, France, Italy, Spain, Hungary, Belgium, Netherlands & Luxembourg, NORDIC(Finland, Sweden, Norway, Denmark), Ireland, Switzerland, Austria, Poland, Turkey, Russia, Rest of Europe), Poland, Turkey, Russia, Rest of Europe) Market Size, Y-O-Y Growth Market Players Analys & Opportunity Outlook

- Asia-Pacific (China, India, Japan, South Korea, Singapore, Indonesia, Malaysia, Australia, New Zealand, Rest of Asia-Pacific) Market Size, Y-O-Y Growth & Market Players Analysis & Opportunity Outlook

- Middle East and Africa (Israel, GCC (Saudi Arabia, UAE, Bahrain, Kuwait, Qatar, Oman), North Africa, South Africa, Rest of Middle East and Africa) Market Size, Y-O-Y Growth Market Players Analysis & Opportunity Outlook

.