Global Smart Connected Washing Machine Market Analysis & Outlook 2030

-

Product Code:

RP-ID-10352066 -

Published Date:

21 Oct 2022 -

Region:

Global

-

Category:

Semiconductor & Electronics -

Publisher:

Pub-ID-54

Impact Analysis on the Growth of Market

Inflation and Looming Recession to Haunt Businesses:

In 2022 & 2023, market players expected to sail in rough waters; might incur losses due to huge gap in currency translation followed by contracting revenues, shrinking profit margins & cost pressure on logistics and supply chain. Further, U.S. economy is expected to grow merely by 3% in 2022.

....

The Research Report is Updated with 2022 Base Year, 2023 Estimated year and Forecast till 2035 with Market Insights.

With the dip in global production, the GDP has contracted in 2020 and impacted the market across the world. Upon placing a Sample Request, you will receive an updated report with 2022 as base year, 2023 as estimated year and forecast to 2035. This will have market drivers, recovery rate in the market, insights and competitive analysis.

Market Overview:

Translate Report

In 2021, the global smart connected washing machine market is estimated to be worth USD 5 billion, and it is expected to grow at a compound annual growth rate (CAGR) of 22% from 2022 to 2030. It is expected that laundry services will drive market growth. In addition, the significant increase in luxury home spending and the increased adoption of smart appliances in the residential sector are driving market growth. The increasing popularity of smart phones and wireless Internet connections will help increase the adoption rate of smart home appliances (such as smart washing machines) in residential and commercial sectors. Technological progress in the smart home category has led to an increase in demand for connected devices such as smart washing machines as a source of luxury and convenience.

Europeans are increasingly adopting automatic washing processes as an important part of daily household activities, which creates profitable growth prospects for the region. In addition, due to the increasing prominence of connected devices, Americans’ greater addiction to smart devices and homes is increasing the sales of smart washing machines. According to Digitized House Media, 3 out of every 5 people in the United States purchase smart home products and monitor their homes via smartphones. According to a blog by NPS Publishing, the smart home penetration rate in 2018 was 7.5%, and it may reach 19.5% in 2022. As a result, the industry’s growing movement is expanding the coverage of smart home appliances in the home, which is expected to drive sales.

In addition, increasingly scarce water resources around the world are forcing manufacturers to design products that use technologies that minimize water consumption. Therefore, compared with traditional washing machines, these Energy Star rated smart washing machines can save a lot of water. For example, Samsung 6.0 cu. FlexWash ™ black stainless steel washers Energy Star rated product models with Wi-Fi connectivity use 4,278 gallons of water per year. However, a traditional washing machine washes about 300 pieces of clothes every year and consumes about 12,000 gallons of water a year. Therefore, in order to solve the increasingly serious water shortage problem, consumers are choosing this kind of efficient and technological integrated washing equipment.

Product information:

Front-loading washing machines have a market share of 55% in 2020 and are expected to record the fastest compound annual growth rate during the forecast period. Despite the higher prices, consumers are increasingly inclined to use traditional front-loading washing machines, which has led to increased product appeal. Due to the large carrying capacity of front-loading washing machines and the energy-saving and water-saving characteristics, consumers are increasingly inclined to adopt front-loading washing machines.Therefore, manufacturers are entering this market segment by launching new products to achieve a greater market share of smart washing machines. For example, in 2018, Xiaomi launched a Mijia smart washing machine with a front 10 kg front in China. From 2020 to 2027, top-loading washing machines are expected to grow at a compound annual growth rate of 23.5%. Convenience and lower prices are key factors driving the demand for top-loading washing machines, especially in developing economies, because of the large number of middle-class customers.

The increasing integration of smart inverter technology into products also helps to promote the application of these machines in residential and commercial fields. For example, the Fischer ; Paykel Smart Drive top loader uses a DC motor to start smoothly. These top-of-the-line chargers are powered by an 800-watt inverter. This situation is driving the global adoption of smart top-loading washing machines.

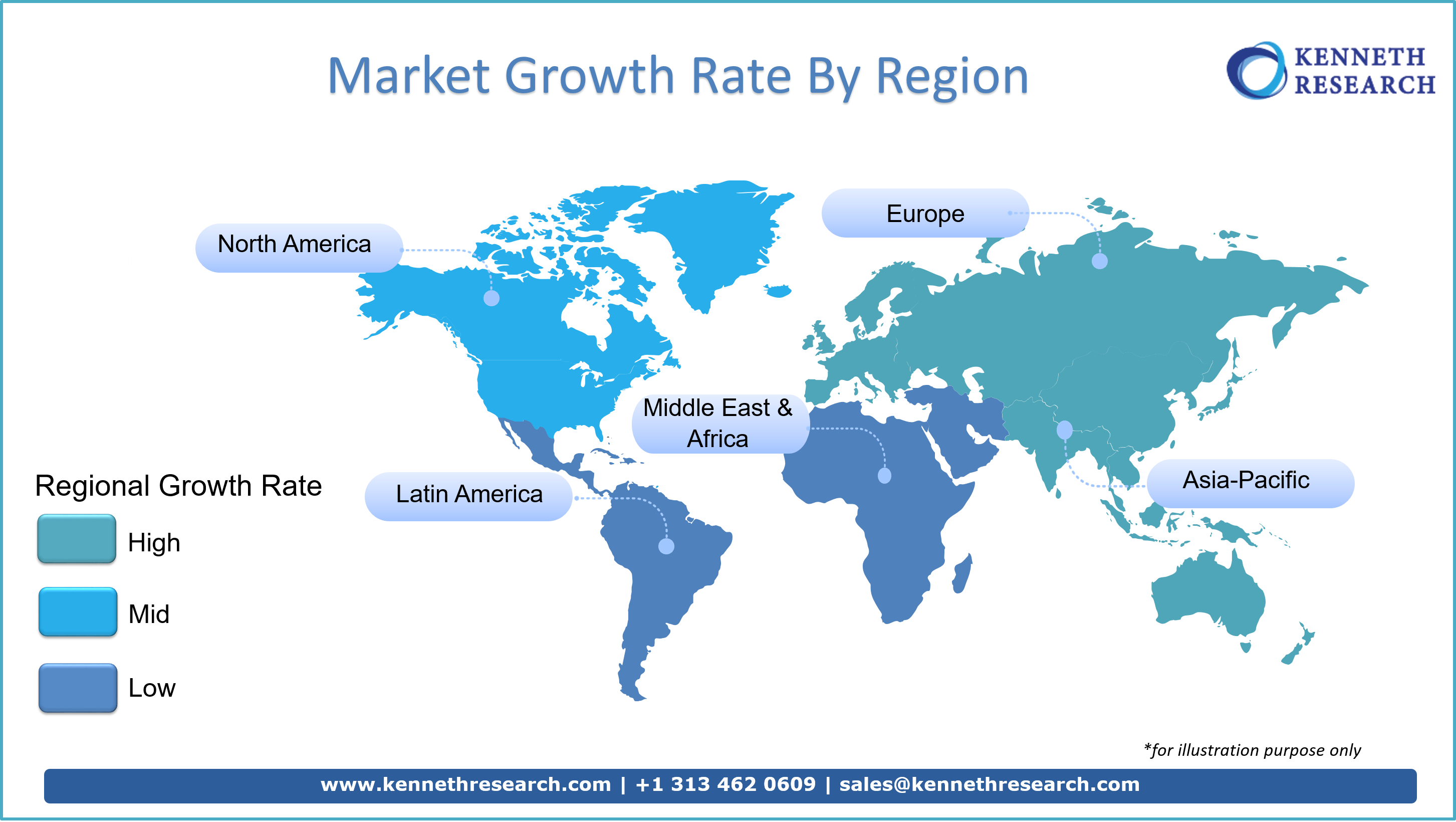

Regional information:

The Asia-Pacific region is expected to grow at the fastest compound annual growth rate of 22% during the forecast period. The Internet penetration rate and technological progress in developing economies such as China and India are expected to drive demand for products in the region. According to the China Internet Network Information Center (CNNIC), the Internet penetration rate in China is 55%. New product development in this industry is paving the way for more adoption of these smart devices. For example, in December 2018, Xiaomi Global Community launched a fully automatic smart washing machine with a load capacity of 10 kg in China. It is equipped with the latest BLDC variable frequency motor, and the price is about 290 US dollars. Due to the increase in the adoption rate of smart appliances in the region, North America;s share in 2019 was 26.0%. In the United States and Canada, consumers; preference for purchasing water-saving and energy-saving products has increased, which has increased the demand for smart washing machines in the region. In addition, more and more smart homes in the region are paving the way for greater popularity of smart washing machines. According to the digital market outlook, by 2024, the number of smart homes in the United States is expected to reach 68.5 million.

Key Companies & Market Share Insights:

The global market is characterized by high competition. Market players are adopting merger and acquisition strategies to enhance product offerings.

Moreover, companies are focusing on expanding their product line through product innovation, particularly in developing economies, to meet the rising demand. For instance, in 2019, TCL Corporation launched new smart home appliances, including washing machines, in India. The company introduced TCL G-series, K-series, and B-series washing machines with front and top-loading capacity. Some of the prominent players in the smart washing machine market include:

Honeywell International Inc.

Koninklijke Philips N.V.

Sunbeam Products, Inc.

Xiaomi Corporation

Blueair

COWAYCO. LTD.

Whirlpool

Americair Corporation

Sharp Corporation

Dyso

Geography Analysis:

The report further discusses the market opportunity, compound annual growth rate (CAGR) growth rate, competition, new technology innovations, market players analysis, government guidelines, export and import (EXIM) analysis, historical revenues, future forecasts etc. in the following regions and/or countries:

- North America (U.S. & Canada) Market Size, Y-O-Y Growth, Market Players Analysis & Opportunity Outlook

- Latin America (Brazil, Mexico, Argentina, Rest of Latin America) Market Size, Y-O-Y Growth & Market Players Analysis & Opportunity Outlook

- Europe (U.K., Germany, France, Italy, Spain, Hungary, Belgium, Netherlands & Luxembourg, NORDIC(Finland, Sweden, Norway, Denmark), Ireland, Switzerland, Austria, Poland, Turkey, Russia, Rest of Europe), Poland, Turkey, Russia, Rest of Europe) Market Size, Y-O-Y Growth Market Players Analys & Opportunity Outlook

- Asia-Pacific (China, India, Japan, South Korea, Singapore, Indonesia, Malaysia, Australia, New Zealand, Rest of Asia-Pacific) Market Size, Y-O-Y Growth & Market Players Analysis & Opportunity Outlook

- Middle East and Africa (Israel, GCC (Saudi Arabia, UAE, Bahrain, Kuwait, Qatar, Oman), North Africa, South Africa, Rest of Middle East and Africa) Market Size, Y-O-Y Growth Market Players Analysis & Opportunity Outlook

.