Fintech Market in India 2020

-

Product Code:

RP-ID-10346777 -

Published Date:

21 Oct 2022 -

Region:

Global

-

Pages:

69 -

Category:

Service Industry -

Publisher:

Pub-ID-13

Impact Analysis on the Growth of Market

Inflation and Looming Recession to Haunt Businesses:

In 2022 & 2023, market players expected to sail in rough waters; might incur losses due to huge gap in currency translation followed by contracting revenues, shrinking profit margins & cost pressure on logistics and supply chain. Further, U.S. economy is expected to grow merely by 3% in 2022.

....

The Research Report is Updated with 2022 Base Year, 2023 Estimated year and Forecast till 2035 with Market Insights.

With the dip in global production, the GDP has contracted in 2020 and impacted the market across the world. Upon placing a Sample Request, you will receive an updated report with 2022 as base year, 2023 as estimated year and forecast to 2035. This will have market drivers, recovery rate in the market, insights and competitive analysis.

Market Overview:

Translate Report

India is one of the fastest-growing fintech markets in the world. As of March 2020, India, alongside China, accounted for the highest fintech adoption rate (87%), out of all the emerging markets in the world. On the other hand, the global average adoption rate stood at 64%. With the burgeoning number of start-ups, the fintech industry in India is attracting increased investments. Initiatives undertaken by the government to drive digitization like demonetization, Jan Dhan Yojana, Aadhaar and Unified Payment Interface (UPI) have further contributed to the growth of the industry.

Market insights:

The fintech market in India was valued at ~INR 1,920.16 Bn in 2019 and is expected to reach ~INR 6,207.41 Bn by 2025, expanding at a compound annual growth rate (CAGR) of ~22.70% during the 2020-2025 period. Increased adoption of the internet and improved digital infrastructure are driving the fintech market in India. However, lack of consumers’ trust on digital modes of payment, and rising threat of cyber and data security are impeding market growth.

Further, the industry is witnessing increased application of artificial intelligence (AI) and Big Data for enhancing personalized offerings. New business models like Neobanks are expected to revolutionize the Indian fintech market.

Segment insights:

Payments, lending, insurtech, wealthtech and banktech are the key operative segments within the fintech market.

The payment segment comprises M-wallets, PPIs, merchant payments, PoS services, international remittance and trading in crypto currencies.

The lending segment includes peer-to-peer lending, crowd funding, loans, online lenders, on-book lending by NBFCs and credit scoring platforms. Insurtech is a niche segment in the Indian fintech ecosystem consisting of insurance aggregators, IoT, wearable and kinematics.

Wealthtech includes robo-advisors, discount brokers and online financial advisors.

The principal function of the banktech segment is to utilize data points like financial transactions and spending patterns to create risk profiles of consumers.

In 2018 and 2019, the payments segment received the highest amount of venture capital investments, followed by the lending and insurtech segments. Wealthtech and banktech are the emerging segments of the industry.

Impact of COVID-19:

As the discretionary spending in the industry has gone down considerably, the number of digital transactions has declined. This has severely hampered cash flow for leading businesses in the country. However, the industry witnessed a ~42% rise in the use of digital payment modes. But purchasing only essential products would not be enough to drive uptake of digital transaction in the Indian fintech ecosystem. Healthcare, bill payments, grocery and food are witnessing rapid digitization, while the entertainment, fashion, travel and tourism industries are at a standstill, thereby reducing transaction volumes in the country and severely affecting the Indian fintech industry.

Competition analysis:

The fintech market in India is highly competitive with incredible growth potential; however, stringent regulatory norms tend to act as significant entry barriers for new players entering the Indian fintech space. The country is growing into a hub for fintech start-ups, and global investors are actively investing in prospective Indian fintech start-ups. In terms of investment, PayTM, Cred, Acko, InCred Finance and BharatPe emerged as the top five fintech players in 2019.

Companies covered:

• ET Money

• ezetap

• Freecharge Payment Technologies Private Limited

• One Mobikwik System Private Limited

• Mswipe Technologies Private Limited

• One97 Communications Limited

• PhonePe Private Limited

• Pine Labs Private Limited

• PolicyBazar.com

• PayU Payments Private Limited

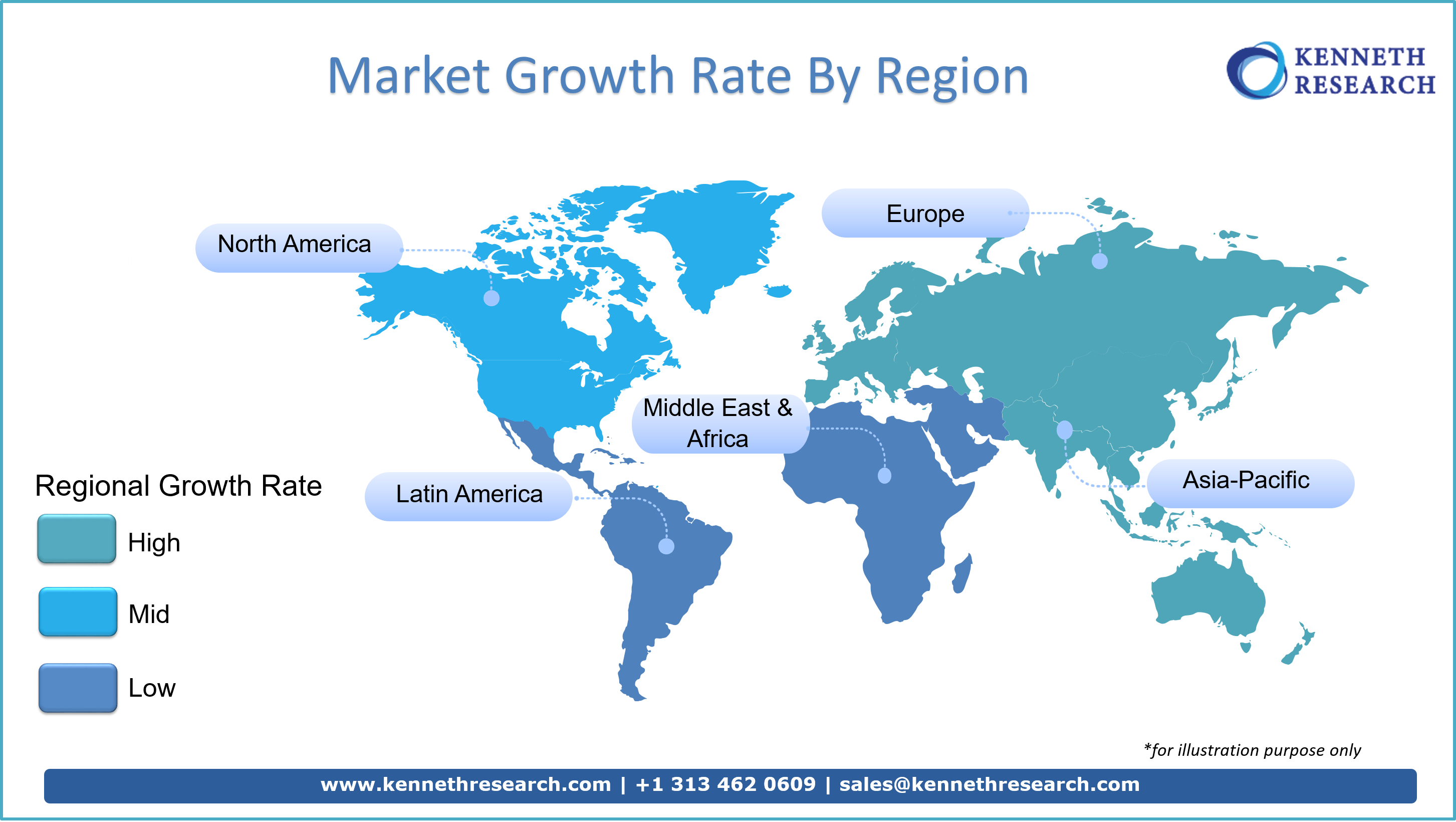

Geography Analysis:

The report further discusses the market opportunity, compound annual growth rate (CAGR) growth rate, competition, new technology innovations, market players analysis, government guidelines, export and import (EXIM) analysis, historical revenues, future forecasts etc. in the following regions and/or countries:

- North America (U.S. & Canada) Market Size, Y-O-Y Growth, Market Players Analysis & Opportunity Outlook

- Latin America (Brazil, Mexico, Argentina, Rest of Latin America) Market Size, Y-O-Y Growth & Market Players Analysis & Opportunity Outlook

- Europe (U.K., Germany, France, Italy, Spain, Hungary, Belgium, Netherlands & Luxembourg, NORDIC(Finland, Sweden, Norway, Denmark), Ireland, Switzerland, Austria, Poland, Turkey, Russia, Rest of Europe), Poland, Turkey, Russia, Rest of Europe) Market Size, Y-O-Y Growth Market Players Analys & Opportunity Outlook

- Asia-Pacific (China, India, Japan, South Korea, Singapore, Indonesia, Malaysia, Australia, New Zealand, Rest of Asia-Pacific) Market Size, Y-O-Y Growth & Market Players Analysis & Opportunity Outlook

- Middle East and Africa (Israel, GCC (Saudi Arabia, UAE, Bahrain, Kuwait, Qatar, Oman), North Africa, South Africa, Rest of Middle East and Africa) Market Size, Y-O-Y Growth Market Players Analysis & Opportunity Outlook

.

Please enter your personal details below

ezetap

Freecharge Payment Technologies Private Limited

One Mobikwik System Private Limited

Mswipe Technologies Private Limited

One97 Communications Limited

PhonePe Private Limited

Pine Labs Private Limited

PolicyBazar.com

PayU Payments Private Limited