Fiber Optic Connector and Cable Assembly Market 2017-2022

-

Product Code:

RP-ID-10078454 -

Published Date:

21 Oct 2022 -

Region:

Global

-

Pages:

100 -

Category:

Semiconductor & Electronics -

Publisher:

Pub-ID-25

Impact Analysis on the Growth of Market

Inflation and Looming Recession to Haunt Businesses:

In 2022 & 2023, market players expected to sail in rough waters; might incur losses due to huge gap in currency translation followed by contracting revenues, shrinking profit margins & cost pressure on logistics and supply chain. Further, U.S. economy is expected to grow merely by 3% in 2022.

....

The Research Report is Updated with 2022 Base Year, 2023 Estimated year and Forecast till 2035 with Market Insights.

With the dip in global production, the GDP has contracted in 2020 and impacted the market across the world. Upon placing a Sample Request, you will receive an updated report with 2022 as base year, 2023 as estimated year and forecast to 2035. This will have market drivers, recovery rate in the market, insights and competitive analysis.

Market Overview:

Translate Report

Fiber Optic Connector and Cable Assembly Market 2017-2022

Important in nearly every aspect of the connector industry, fiber optic technologies are playing an increasingly key role in the future growth of the connector industry.

Which fiber optic connector and assembly types currently dominate the market? Will this change in the next five years?

Which fiber optic connector types will exhibit strongest growth over the next five-years? What fiber optic connector types will show the least growth?

What applications are driving the growth of fiber optic connectors and assemblies?

In which market sector are fiber optic connectors and assemblies most prevalent? Will this change over the next five-years? What types of applications within this sector are driving this growth?

Which suppliers are best aligned to address this growing market?

Bishop & Associates newest research report, Fiber Optic Connector and Cable Assembly Market 2017-2022, provides answers to these questions and others. A product type that is finding application in every market sector, fiber optic connectors are forecasted to be one of the strongest growing connector types over the next five-years. What are the market trends? What technology developments lead to new FO connector design? And in which regions will the greatest growth occur? Make sure your company is prepared as the market for fiber optic connectors explodes, order your copy of Fiber Optic Connector and Cable Assembly Market 2017-2022.

Fiber Optic Connector and Cable Assembly Market 2017-2022

Bishop and Associates, Inc. announces the release of a new five-chapter, 157-page research report providing an in-depth analysis of fiber-optic connectors, cable assemblies, and the technologies that enable their use as well as the applications in which they are utilized. Providing a detailed analysis by region and fiber optic connector and assembly type, Fiber Optic Connector and Cable Assembly Market 2017-2022 highlights likely new fiber optic connector business opportunities for connector and cable assembly companies. Detailed information is provided for the period 2017 through 2022.

Fiber optic technologies have become increasingly important in every aspect of the connector industry. From plastic optical fiber (POF) used in automobile communications systems to embedded optics in high-performance computing (HPC), fiber optic connector use is growing. Although not all regions are growing at the same rate, significant growth is anticipated in all regions over the next five-years, with some regions close to doubling their current sales.

With well over 15 different industry standard fiber optic connector types available, customers have a wide variety of connector styles to pick from, all offering unique characteristics and attributes. During the forecast period, the largest revenue opportunities for fiber optic connectors are in the telcom/datacom market sector and LC connectors. The largest growth market is with embedded optics and therefore mid-plane and backplane connectors.

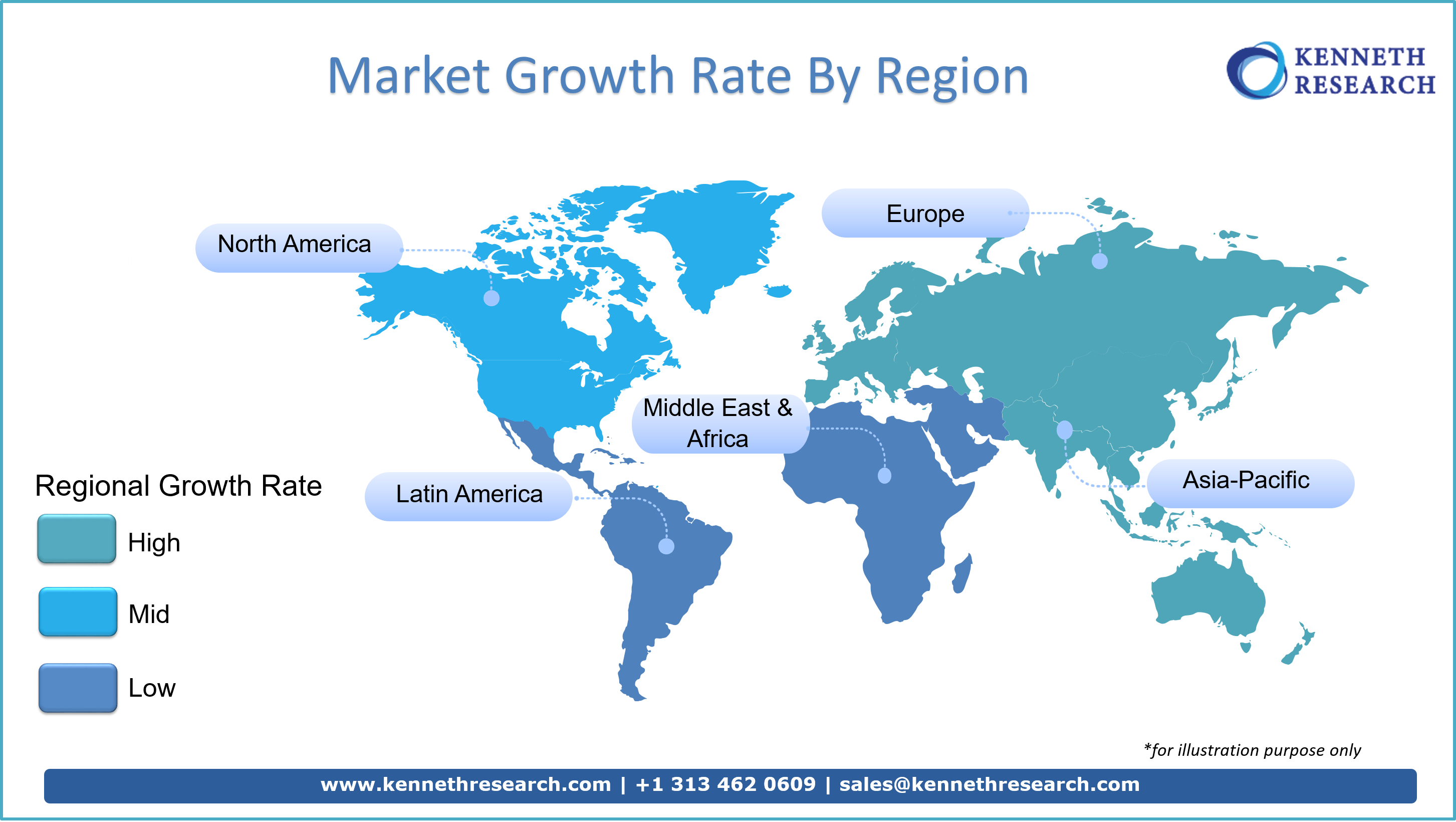

Geography Analysis:

The report further discusses the market opportunity, compound annual growth rate (CAGR) growth rate, competition, new technology innovations, market players analysis, government guidelines, export and import (EXIM) analysis, historical revenues, future forecasts etc. in the following regions and/or countries:

- North America (U.S. & Canada) Market Size, Y-O-Y Growth, Market Players Analysis & Opportunity Outlook

- Latin America (Brazil, Mexico, Argentina, Rest of Latin America) Market Size, Y-O-Y Growth & Market Players Analysis & Opportunity Outlook

- Europe (U.K., Germany, France, Italy, Spain, Hungary, Belgium, Netherlands & Luxembourg, NORDIC(Finland, Sweden, Norway, Denmark), Ireland, Switzerland, Austria, Poland, Turkey, Russia, Rest of Europe), Poland, Turkey, Russia, Rest of Europe) Market Size, Y-O-Y Growth Market Players Analys & Opportunity Outlook

- Asia-Pacific (China, India, Japan, South Korea, Singapore, Indonesia, Malaysia, Australia, New Zealand, Rest of Asia-Pacific) Market Size, Y-O-Y Growth & Market Players Analysis & Opportunity Outlook

- Middle East and Africa (Israel, GCC (Saudi Arabia, UAE, Bahrain, Kuwait, Qatar, Oman), North Africa, South Africa, Rest of Middle East and Africa) Market Size, Y-O-Y Growth Market Players Analysis & Opportunity Outlook

.