Family Office Market Analysis by Services (Advisory, Governance, Strategy, and Financial Planning); by Type (Multi, and Single- Family Office); and by Net Worth Managed (More than 100 Million, Less than 50 Million, and 50 Million to 100 Million)-Global Supply & Demand Analysis & Opportunity Outlook 2022-2031

-

Product Code:

RP-ID-10346745 -

Published Date:

4 Nov 2022 -

Region:

Global

-

Category:

Service Industry -

Publisher:

Pub-ID-54

Impact Analysis on the Growth of Market

Inflation and Looming Recession to Haunt Businesses:

In 2022 & 2023, market players expected to sail in rough waters; might incur losses due to huge gap in currency translation followed by contracting revenues, shrinking profit margins & cost pressure on logistics and supply chain. Further, U.S. economy is expected to grow merely by 3% in 2022.

....

The Research Report is Updated with 2022 Base Year, 2023 Estimated year and Forecast till 2035 with Market Insights.

With the dip in global production, the GDP has contracted in 2020 and impacted the market across the world. Upon placing a Sample Request, you will receive an updated report with 2022 as base year, 2023 as estimated year and forecast to 2035. This will have market drivers, recovery rate in the market, insights and competitive analysis.

Market Overview:

Translate Report

Global Family Office Market Scope

|

Base Year |

2021 |

|

Forecast Year |

2022-2031 |

|

CAGR |

~5% |

|

Base Year Market Size (2021) |

~ USD 19.0 Billion |

|

Forecast Year Market Size (2031) |

~ USD 30.0 Billion |

Global Family Office Market Size, Forecast, and Trend Highlights Over 2022 - 2031

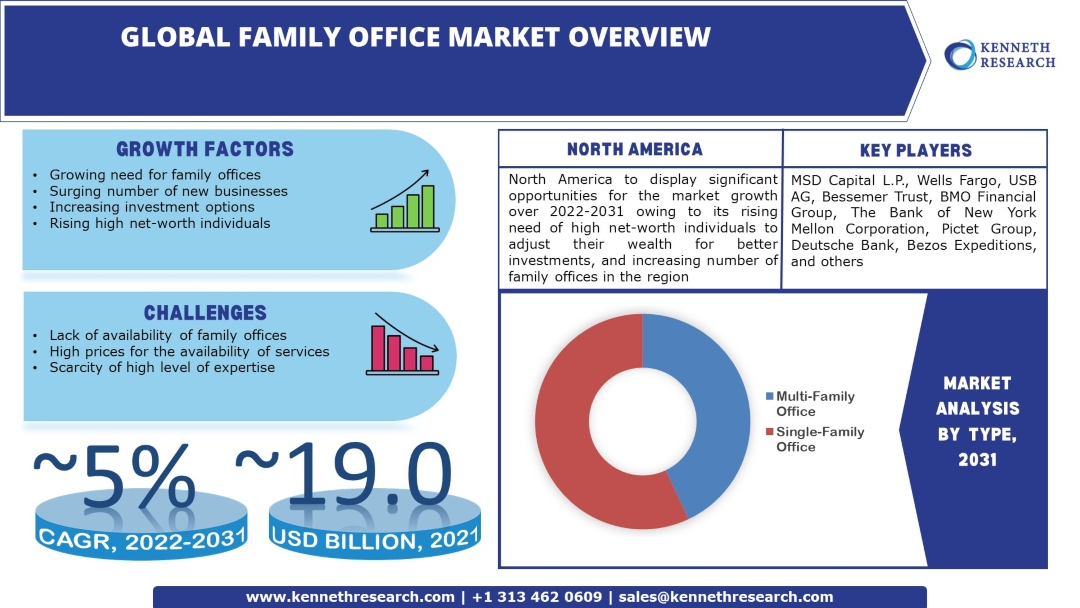

The global family office market is estimated to garner a revenue of USD 30.0 Billion by the end of 2031 by growing at a CAGR of ~5% over the forecast period, i.e., 2022 – 2031. Further, the market generated a revenue of USD 19.0 Billion in the year 2021. The growth of the market can be attributed to the rising high net-worth individuals. As per the Global Wealth Report 2021, the global household wealth at the end of the year 2020 increased by 7.4 percent accounting for USD 418.3 trillion.

GET A SAMPLE COPY OF THIS REPORT

Family offices offer a wide range of private wealth management services to one or a few ultra-high-net-worth families. It is majorly divided on the basis of type into single-family office and multi-family office for providing services according to the needs of high net-worth individuals. Moreover, the services provided by the family office include governance, financial planning, strategy, advisory, and others. Therefore, it is anticipated to surge in the growth of the global family office market. The number of family offices has raised by more than 35 percent in Quarter 2 as compared to 2018

Global Family Office Market: Growth Drivers and Challenges

Growth Drivers

-

Surging Number of New Businesses– People across the world are investing in new businesses with the expectation of earning high profits. Furthermore, the right business to invest in requires the advice of experts, and it is anticipated to increase the growth of the global family office market. There has been an increase in the number of large enterprises from more than 635 thousand in the year 2016 in terms of employees to more than 680 thousand in the year 2019

-

Increasing Investment Options – Family offices provide the best option for investments for high-wealth individuals. Hence, it is projected to surge the growth of the global family office market. More than 50 percent of the adults have invested in the stock in the United States

-

Growing Need for Better Insurance Option– The global insurance penetration was more than the average of 7 percent in 2019.

-

Increasing Number of Billionaires– The number of Billionaires has increased from nearly 100 to 140 in India in the year 2021.

Challenges

-

Lack of Availability of Family Offices

-

High Prices for the Availability of Services

-

Scarcity of High Level of Expertise

The global family office market is segmented and analyzed for demand and supply by type into multi, and single-family office. Out of these, the single-family office segment is anticipated to hold the largest share over the forecast period owing to the rising number of billionaires, and the increasing need of the wealthier person to avail the services 24/7 hours as per their own needs. For instance, there are more than 2,700 billionaires in 2021 around the world.

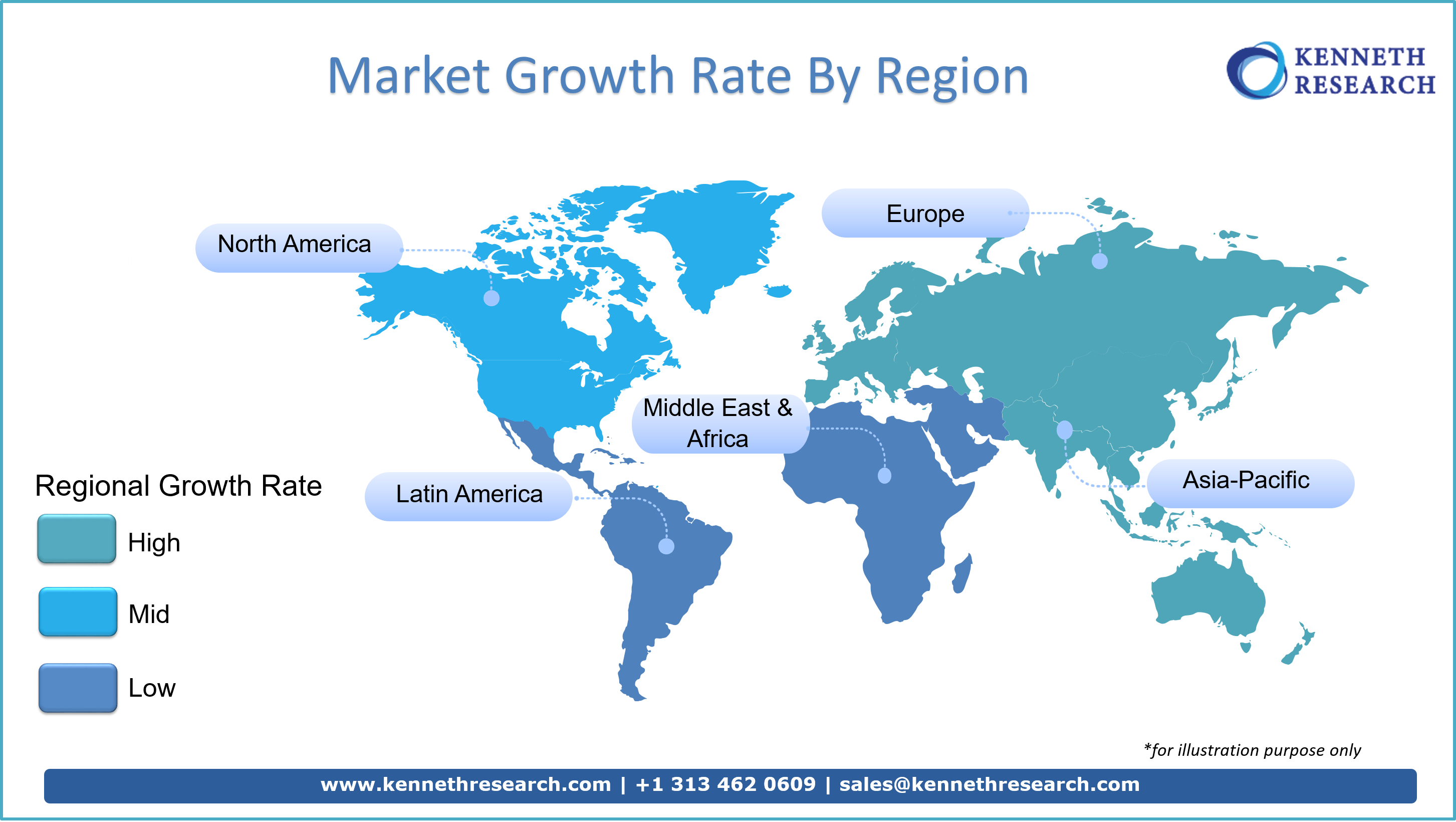

Global Family Office Market Regional Synopsis

Regionally, the global family office market is studied into five major regions including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa region. Amongst these markets, the market in the North America region is projected to hold the largest market share by the end of 2031 on the back of the rising need of high net-worth individuals to adjust their wealth for a better investment, and the increasing number of family offices in the region. For instance, the total number of global family offices accounted for more than 7000 at the end of Q2 in the year 2019. Out of these, the North America region had the largest share of more than 40 percent.

Market Segmentation

Our in-depth analysis of the global family office market includes the following segments:

|

By Services |

|

|

By Type |

|

|

By Net Worth Managed |

|

Customize this Report: Request Customization

Key Companies Dominating the Global Family Office Market

Our report has covered detailed company profiling comprising company overview, business strategies, key product offerings, financial performance, key performance indicators, risk analysis, recent developments, regional presence, and SWOT analysis among other notable indicators for competitive positioning. Some of the prominent industry leaders in the global family office market that are included in our report are Bessemer Trust, Deutsche Bank, USB AG, Cascade Investment Group, Bezos Expeditions, BMO Financial Group, Pictet Group, The Bank of New York Mellon Corporation, Wells Fargo, MSD Capital L.P., and others.

Global Family Office Market: Latest Developments

-

July, 2020: Deutsche Bank and BNY Mellon announced the collaboration to improve confirmation times for restricted emerging-market currency trades through creating a new API-enabled foreign exchange solution

-

June, 2019: USB AG and Sumitomo Mitsui Trust Holding, Inc., announced the partnership to launch a strategic wealth management venture in Japan

Key Reasons to Buy Our Report

-

The report covers a detailed analysis comprising market share attained by each market segment and its sub-segments.

-

It covers market dynamics including growth drivers, trends, potential opportunities, price trend analysis, and challenges that impact market growth.

-

The report includes detailed company profiles of the major players dominating the market.

-

We use effective research methodologies to calculate the market numbers and provide value-added assessment for overall growth.

-

We provide customized reports as per the clients’ requirement helping them to see possible and unexpected challenges and unforeseen opportunities in order to help them reach their goal.

Geography Analysis:

The report further discusses the market opportunity, compound annual growth rate (CAGR) growth rate, competition, new technology innovations, market players analysis, government guidelines, export and import (EXIM) analysis, historical revenues, future forecasts etc. in the following regions and/or countries:

- North America (U.S. & Canada) Market Size, Y-O-Y Growth, Market Players Analysis & Opportunity Outlook

- Latin America (Brazil, Mexico, Argentina, Rest of Latin America) Market Size, Y-O-Y Growth & Market Players Analysis & Opportunity Outlook

- Europe (U.K., Germany, France, Italy, Spain, Hungary, Belgium, Netherlands & Luxembourg, NORDIC(Finland, Sweden, Norway, Denmark), Ireland, Switzerland, Austria, Poland, Turkey, Russia, Rest of Europe), Poland, Turkey, Russia, Rest of Europe) Market Size, Y-O-Y Growth Market Players Analys & Opportunity Outlook

- Asia-Pacific (China, India, Japan, South Korea, Singapore, Indonesia, Malaysia, Australia, New Zealand, Rest of Asia-Pacific) Market Size, Y-O-Y Growth & Market Players Analysis & Opportunity Outlook

- Middle East and Africa (Israel, GCC (Saudi Arabia, UAE, Bahrain, Kuwait, Qatar, Oman), North Africa, South Africa, Rest of Middle East and Africa) Market Size, Y-O-Y Growth Market Players Analysis & Opportunity Outlook

.

FREQUENTLY ASKED QUESTIONS

Increasing number of billionaires, rising high net-worth individuals, increasing investment options, and surging number of new businesses

The market is anticipated to attain a CAGR of ~5% over the forecast period, i.e., 2022 – 2031.

Lack of availability of family offices, high prices for the availability of services, and scarcity of high level of expertise

The market in the North America region is projected to hold the largest market share by the end of 2031 and provide more business opportunities in the future.

The major players in the market are Bessemer Trust, Deutsche Bank, USB AG, Cascade Investment Group, Bezos Expeditions, BMO Financial Group, Pictet Group, The Bank of New York Mellon Corporation, Wells Fargo, MSD Capital L.P., and others.

The company profiles are selected based on the revenues generated from the product segment, geographical presence of the company which determine the revenue generating capacity as well as the new products being launched into the market by the company.

The market is segmented by services, type, net worth managed, and by region.

The single-family office segment is anticipated to garner the largest market size by the end of 2031 and display significant growth opportunities.

Please enter your personal details below

- Bessemer Trust

- Deutsche Bank

- USB AG

- Cascade Investment Group

- Bezos Expeditions

- BMO Financial Group

- Pictet Group

- The Bank of New York Mellon Corporation

- Wells Fargo

- MSD Capital L.P.