ATM Managed Services Market SHARE, TREND, OPPORTUNITY AND FORECAST

-

Product Code:

RP-ID-10075622 -

Published Date:

21 Oct 2022 -

Region:

Global

-

Pages:

99 -

Category:

Service Industry -

Publisher:

Pub-ID-9

Impact Analysis on the Growth of Market

Inflation and Looming Recession to Haunt Businesses:

In 2022 & 2023, market players expected to sail in rough waters; might incur losses due to huge gap in currency translation followed by contracting revenues, shrinking profit margins & cost pressure on logistics and supply chain. Further, U.S. economy is expected to grow merely by 3% in 2022.

....

The Research Report is Updated with 2022 Base Year, 2023 Estimated year and Forecast till 2035 with Market Insights.

With the dip in global production, the GDP has contracted in 2020 and impacted the market across the world. Upon placing a Sample Request, you will receive an updated report with 2022 as base year, 2023 as estimated year and forecast to 2035. This will have market drivers, recovery rate in the market, insights and competitive analysis.

Market Overview:

Translate Report

ATM Managed Services Market Overview

ATM managed services deal with proper maintenance of ATM and also assures standardized processing of ATM network. ATM managed service provider work in a way to reduce the potential of ATM related issues. Further, ATM managed services offer features such as ATM monitoring, ATM management, ATM procurement, cash management and provides services to the banks in order to improve the customer’s experience. Moreover, ATM managed services also let ATMs to operate on similar software interface in order to provide consumers with a standard user experience. ATM managed services also manage the standardization of features including camera security, cash transfer, bill payment, card less transaction, cash withdrawal and other additional features.

Market Size & Forecast

Global ATM managed services market is expected to grow at compound annual growth rate of 11.2% during the forecast period i.e.2017-2024. Rising need for better management of ATMs in order to improve customer’s experience has led banks to adopt ATM managed services. Further, global ATM managed services market is anticipated to grow at maximum pace during the forecast period on the account of growing global ATM market.

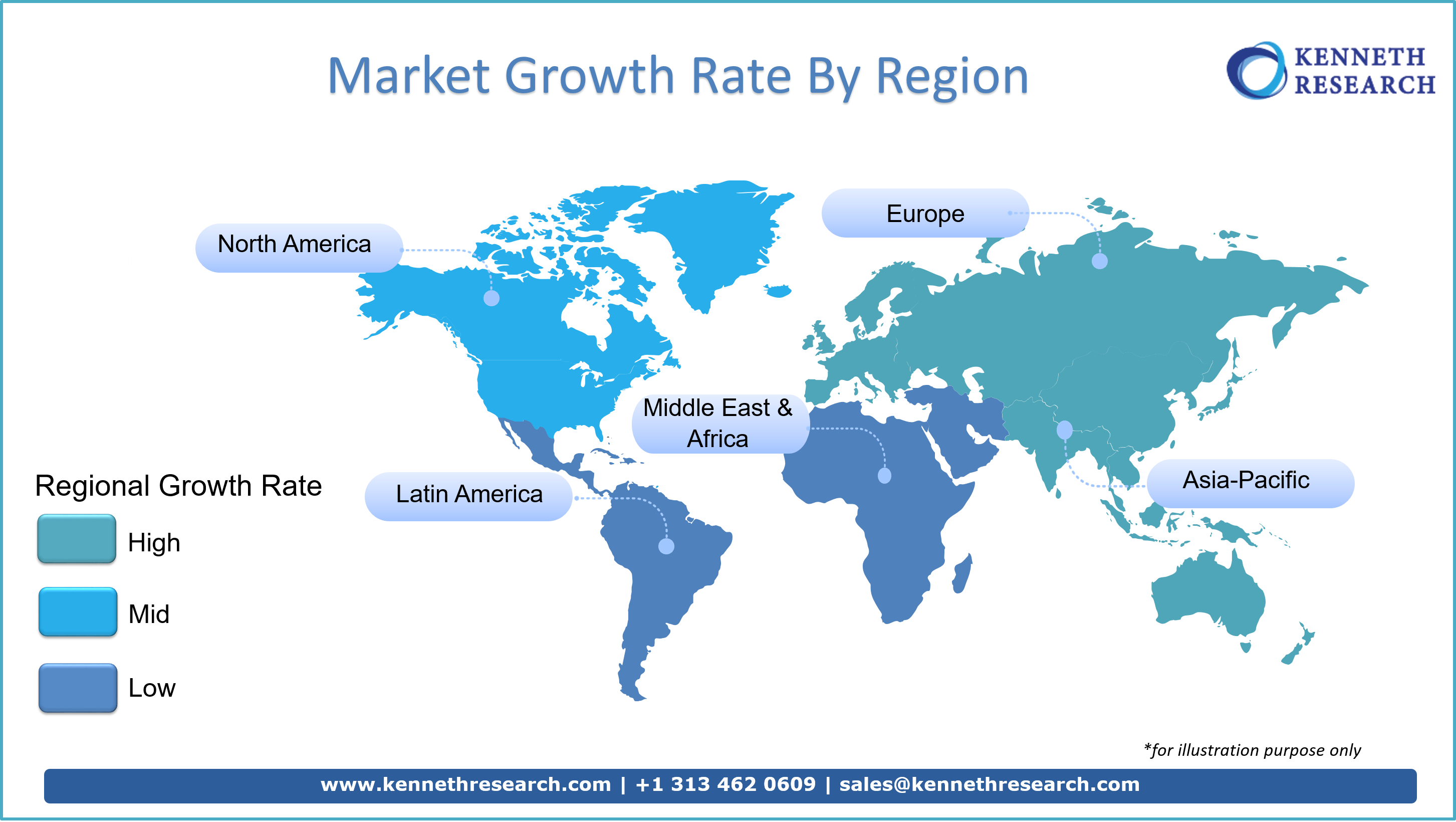

In terms of region, global ATM managed services market is expected to be dominate by North America region during the forecast period. Rising need for better management and maintenance of ATMs is a key factor which is likely to bolster the market of ATM managed services in North America region. Moreover, U.S. is expected to dominate the market of ATM managed services in this region over the forecast period.

Over the past few years, it has been observed that the number of automated teller machines is increasing in Asia Pacific region. Additionally, number of financial institutes and ATMs is increasing rapidly in this region. Growing consumer’s expectations with bank services in Asia Pacific region is another serious factor which is envisioned to fuel the growth of ATM managed services market in this region. Additionally, recent demonetization in India has fueled the need for proper management of ATM channel in this country. This growing need for better ATM management system is likely to be the dynamic factor behind the growth of ATM managed services market in Asia Pacific region.

Moreover, Europe region is also expected to witness a significant growth during the forecast period. This growth of ATM managed services market in Europe region can be attributed to factors such growing concern among various financial institutions towards consumer’s experience.

Market Segmentation

Our-in depth analysis of the global ATM managed services market includes the following segments:

By ATM Type

Conventional ATM

White Label ATM

Black Label ATM

Cash Dispenser

Smart ATM

By Service

Electronic Journal & Content Management System

ATM Service & Repair

First Line ATM Maintenance

Second Line ATM Maintenance

ATM Deposit Automation

ATM Transaction Processing

Cash Management

Software Maintenance

Cash Reconciliation Services

By Region

Global ATM managed services market is further classified on the basis of region as follows:

North America (United States, Canada), Market size, Y-O-Y growth Market size, Y-O-Y growth & Opportunity Analysis, Future forecast & Opportunity Analysis

Latin America (Brazil, Mexico, Argentina, Rest of LATAM), Market size, Y-O-Y growth, Future forecast & Opportunity Analysis

Europe (U.K., Germany, France, Italy, Spain, Hungary, BENELUX (Belgium, Netherlands, Luxembourg), NORDIC (Norway, Denmark, Sweden, Finland), Poland, Russia, Rest of Europe), Market size, Y-O-Y growth, Future forecast & Opportunity Analysis

Asia-Pacific (China, India, Japan, South Korea, Malaysia, Indonesia, Taiwan, Hong Kong, Australia, New Zealand, Rest of Asia-Pacific), Market size, Y-O-Y growth, Future forecast & Opportunity Analysis

Middle East and Africa (Israel, GCC (Saudi Arabia, UAE, Bahrain, Kuwait, Qatar, Oman), North Africa, South Africa, Rest of Middle East and Africa), Market size, Y-O-Y growth, Future forecast & Opportunity Analysis

ATM managed services market

Growth Drivers & Challenges

In order to provide convenience to the customers, prevalence of ATMs in commercial & public places has increased over the past few years. Further, growing number of ATMs is a key factor which has outpaced the demand for ATM managed services. Further, adoption of ATM managed services is growing just to assure smooth and error less management of ATMs.

Furthermore, additional advantages of ATM managed services including compliance with new regulations, improved operational profit & loss and other advantages are anticipated to be the major drivers to the growth of global ATM managed services market.

In addition to this, security of ATM booths is one of the major concerns for the banks. ATM managed services also help banks in order to update security technology and improve safety level of ATM. This feature of ATM managed services is anticipated to fuel the demand for these services in near future.

Some other advantages offered by ATM managed services are simplified network operation, system updates, troubleshooting & services. These beneficial features of ATM managed services are likely to escalate the adoption rate of these services in the banks during the forecast period.

However, encouragement of cashless transactions and digital payments by banks and government is reducing the demand for ATMs which further is expected to inhibit the growth of global ATM managed services market. This factor is expected to hinder the growth of global ATM managed services market.

Key Players

NCR Managed Services

Company Overview

Key Product Offerings

Business Strategy

SWOT Analysis

Financials

FssTech

Cashlink Global System Pvt. Ltd.

Automated Transaction Delivery (ATM Worldwide)

Electronic Payment and Services Pvt. Ltd.

First Data

CashTrans

Vocalink

QDS (Quality Data Systems)

Geography Analysis:

The report further discusses the market opportunity, compound annual growth rate (CAGR) growth rate, competition, new technology innovations, market players analysis, government guidelines, export and import (EXIM) analysis, historical revenues, future forecasts etc. in the following regions and/or countries:

- North America (U.S. & Canada) Market Size, Y-O-Y Growth, Market Players Analysis & Opportunity Outlook

- Latin America (Brazil, Mexico, Argentina, Rest of Latin America) Market Size, Y-O-Y Growth & Market Players Analysis & Opportunity Outlook

- Europe (U.K., Germany, France, Italy, Spain, Hungary, Belgium, Netherlands & Luxembourg, NORDIC(Finland, Sweden, Norway, Denmark), Ireland, Switzerland, Austria, Poland, Turkey, Russia, Rest of Europe), Poland, Turkey, Russia, Rest of Europe) Market Size, Y-O-Y Growth Market Players Analys & Opportunity Outlook

- Asia-Pacific (China, India, Japan, South Korea, Singapore, Indonesia, Malaysia, Australia, New Zealand, Rest of Asia-Pacific) Market Size, Y-O-Y Growth & Market Players Analysis & Opportunity Outlook

- Middle East and Africa (Israel, GCC (Saudi Arabia, UAE, Bahrain, Kuwait, Qatar, Oman), North Africa, South Africa, Rest of Middle East and Africa) Market Size, Y-O-Y Growth Market Players Analysis & Opportunity Outlook

.